2024 BHHS Real Estate Report

Introducing the 2024 Real Estate Report from Berkshire Hathaway HomeServices—your guide to navigating today's dynamic market landscape. With the current market at a pivotal juncture, the insights within this report are more pertinent than ever.

Dive into this comprehensive resource to uncover timely advice on a range of critical topics, including remodeling, lessons from lifelong real estate agents, and generational differences in the real estate market—plus the 5 things both buyers and sellers need to know right now.

This is essential reading for anyone interested in the state of today’s global real estate market.

READ REPORT

2024 European Summer Report

Unveiling the 2024 European Summer Report from Berkshire Hathaway HomeServices—a treasure trove of insights into real estate markets across the continent. Amongst these pages, you’ll discover valuable information on popular avenues to residency, key considerations for homebuyers, and emerging locations to watch in the coming months.

This is essential reading for anyone with an interest in Europe’s vibrant real estate market.

READ THE REPORT

Cottages vs New Capital Gains Tax

The Canadian government's recent changes to the capital gains tax have left many family cottage owners wondering how to navigate the new rules. If you're one of them, you're not alone. In this blog, we'll explore a couple of options to consider in the short term, including:

1. Designating the cottage as your primary residence

2. Gifting the property to your kids now

3. Adding owners to the property

Under current regulations, capital gains are taxed at a 50 per cent inclusion rate, meaning you pay tax on 50% of the profit that you make on an investment. For a property this is calculated by deducting the original purchase price from the selling price less any capital expenditures made on the property such as major renovations or repairs.

As of June 25th, the inclusion rate will increase to 67 per cent on gains exceeding $250,000 in any given year. For a cottage that is sold with a $1,000,000 gain this would now create a taxable benefit of $670,000 vs $500,000 under the previous rules. Ultimately this would equate to about $80,000 in additional taxes. While this may not seem signicant on the surface, especially when the return is $1,000,000, for those who might have been planning to divest or pass down their cottage in the near term, it is an impactful difference.

Option 1: Designate the Cottage as a Primary Residence

If the gain on your cottage property is or is going to be larger than your current home, it may be wise to designate the cottage as your primary residence. The same goes for parents who may want to pass down a cottage to their children in the future. Primary residences are exempt from capital gains taxes and so this strategy will minimize the tax burden on your asset with the largest potential gain. In addition, principal residences that are inherited by children are exempt capital gains at the time of inheritance.

Option 2: Gift the Property to Your Kids

Gifting the cottage property to your children before the tax takes effect can help minimize capital gains tax. This option allows you to transfer the property at its current value, reducing the gain and subsequent tax liability.

It is important to note that when secondary properties are inhertied by children, capital gains must be paid at the time of inheritance. In short, capital gains will have to be paid in these types of properties as some point, so paying them now at the lower rate can be beneficial.

Option 3: Adding Owners to a Property

A final option would be to add your kid or kids to the ownership of the property, even if you aren't sure what you want to do with the property in the future. Having multiple owners on a property allows you to spread any potential gains across each owner in order to keep the gain for each person under the $250,000 limit. Of course this strategy only works if the gain can be split amongst the owners and result in less than $250,000 per person.

Conclusion

Navigating the new Canadian capital gains tax on family cottage properties requires careful consideration and advice from a tax expert. With the June 25th deadline fast approaching, time is of the essence. Those who may be impacted by these changes should act quickly in order to make the most informed and profitable decisions.

Generations in Toronto Real Estate: Understanding the Shift

The Toronto real estate market is undergoing a significant transformation, driven by the changing needs and preferences of different generations. As the city's population continues to evolve, it's essential to understand the distinct characteristics, priorities, and behaviors of each age group to navigate the complex and dynamic real estate landscape.

While the term “generation gap” was coined in the 1960s to describe political and social differences between generations, plenty of people today see a gap between the priorities and pressures faced by Baby Boomers, Gen Xers and Millennials when it comes to the real estate market. First-time buyers continue to make up a lower percentage of the market, while the share of investors continues to increase year over year . The typical first-time buyer in 2023 was 33, firmly in the millennial generation. In addition, the share of buyers with children under the age of 18 dropped to historic lows. This shift is likely due to a higher share of older repeat buyers and an overall drop in birth rates and people having children later in life.

Real estate markets vary by geographical region, but a few generational patterns appear to be Universal.

First-time buyers aren't interested in anything that doesn't look good

They're not interested at all in a fixer-upper

Many sellers have an expectations gap

Sellers think they don’t have to fix up their houses but buyers don’t want to do work, especially if they're using all their resources to buy the property

Baby Boomers

Baby Boomers, born between 1946 and 1964, are a significant demographic in the Toronto real estate market. As this generation retires and downsizes, they're impacting the housing landscape with their unique preferences, priorities, and purchasing power. In this blog, we'll explore the demographics of Baby Boomers in the Toronto real estate market, examining their population, age, family structure, income, education, homeownership, and housing preferences.

Population and Age

Baby Boomers make up approximately 25% of Toronto's population, with a median age of 65-74 years old. This generation is entering retirement, driving demand for age-friendly housing options and communities.

Family and Household Structure

Baby Boomers are largely empty nesters, with 60% living alone or with a spouse. However, 20% are still raising children, and 15% are caring for aging parents. This demographic shift drives demand for smaller, low-maintenance housing options and age-friendly communities.

Income and Education

Baby Boomers are largely retired or semi-retired, with a median household income of $55,400 in Toronto. This generation values financial security and stability, prioritizing affordable housing options and predictable expenses. Baby Boomers are also highly educated, with 60% holding a post-secondary degree or diploma.

Homeownership and Housing Preferences

Baby Boomers are longtime homeowners, with 80% owning their homes. As they downsize, they prioritize:

Smaller, low-maintenance homes

Age-friendly communities with amenities

Proximity to family, friends, and healthcare

Affordable, predictable housing costs

Impact on the Toronto Real Estate Market

Baby Boomers are influencing demand for:

Age-friendly housing options, such as condos and townhouses

Smaller, low-maintenance homes

Communities with amenities, like parks and community centers

Affordable, predictable housing costs

Generation X

When it comes to the Toronto real estate market, much attention is focused on the Baby Boomers and Millennials. However, Generation X (born between 1965 and 1980) is a crucial demographic that should not be overlooked. As the middle child of the generational spectrum, Gen Xers are often misunderstood, but they play a vital role in shaping the Toronto real estate market. In this blog, we'll delve into the demographics of Gen X in Toronto and explore their impact on the real estate landscape.

Population and Age

Gen Xers make up approximately 23% of Toronto's population, with a median age of 45-54 years old. This generation is now in their prime earning years, with many established in their careers and raising families.

Family and Household Structure

Gen Xers are more likely to be married with children than their Millennial counterparts. According to Statistics Canada, 70% of Gen Xers are married or in common-law relationships, with an average of 1.9 children per household. This family-oriented demographic drives demand for family-friendly housing, particularly in suburban areas with good schools and community amenities.

Income and Education

Gen Xers are well-educated, with 65% holding a post-secondary degree or diploma. This education has translated to higher earning potential, with a median household income of $93,400 in Toronto. As a result, Gen Xers are a significant force in the Toronto real estate market, driving demand for mid-to-high-end properties.

Homeownership and Housing Preferences

Gen Xers are more likely to own their homes than rent, with 65% being homeowners. When it comes to housing preferences, Gen Xers prioritize:

Space: Gen Xers need room for their families, seeking homes with multiple bedrooms and ample living areas.

Location: Proximity to good schools, public transportation, and community amenities is crucial for Gen Xers.

Practicality: This generation values functional, low-maintenance homes with modern amenities.

Impact on the Toronto Real Estate Market

Gen Xers are a driving force in the Toronto real estate market, influencing demand for:

Family-friendly housing in suburban areas

Mid-to-high-end properties with modern amenities

Practical, low-maintenance homes with functional living spaces

Neighborhoods with good schools, public transportation, and community amenities

Millennials

Millennials, born between 1981 and 1996, are a significant force in the Toronto real estate market. As the largest generation in Canadian history, Millennials are shaping the city's housing landscape with their unique preferences, priorities, and purchasing power. In this blog, we'll explore the demographics of Millennials in the Toronto real estate market, examining their population, age, family structure, income, education, homeownership, and housing preferences.

Population and Age

Millennials make up approximately 30% of Toronto's population, with a median age of 25-34 years old. This generation is entering their prime homebuying years, with many seeking housing options that fit their urban, amenity-rich lifestyle.

Family and Household Structure

Millennials are delaying marriage and starting families later in life, with 45% living alone or with roommates. However, 30% are married or in common-law relationships, with an average of 1.4 children per household. This demographic shift drives demand for smaller, urban housing options and amenity-rich communities.

Income and Education

Millennials are highly educated, with 65% holding a post-secondary degree or diploma. While their median household income is lower than previous generations, ($63,400 in Toronto), they prioritize experiences and convenience over material possessions. This generation is driving demand for affordable, urban housing with access to public transportation and community amenities.

Homeownership and Housing Preferences

Millennials are slower to enter homeownership due to factors like student debt and affordability concerns. However, 40% are homeowners, with a preference for:

Urban locations: Millennials prioritize proximity to public transportation, entertainment, and cultural attractions.

Amenities: This generation values amenities like gyms, rooftop terraces, and community spaces.

Sustainability: Millennials prioritize eco-friendly features and energy efficiency in their homes.

Affordability: With limited budgets, Millennials seek affordable housing options, including condos and townhouses.

Millennials are a driving force in the Toronto real estate market, influencing demand for:

Urban, amenity-rich housing options

Affordable, compact living spaces

Sustainable and eco-friendly homes

Neighborhoods with public transportation, entertainment, and cultural attractions

Key Takeaways

Each generation brings unique preferences and priorities to the Toronto real estate market.

Shifts in demographics and lifestyles are driving demand for diverse housing types, from condos to family-friendly homes.

Technology and digital convenience are increasingly important for real estate transactions and property management.

Sustainability, community, and inclusivity are becoming key considerations for younger generations.

Understanding generational differences can help real estate professionals, policymakers, and developers cater to the diverse requirements of Toronto's changing population.

The Toronto real estate market is evolving in response to generational changes, with each age group bringing distinct perspectives and needs. By understanding these shifts, we can create a more inclusive and thriving real estate market that caters to the diverse requirements of Toronto's changing population. As the city continues to grow and evolve, embracing generational changes will be crucial for building a vibrant, sustainable, and resilient real estate market for generations to come.

New Capital Gains Rules in Canada: Impact on Real Estate

The 2024 Federal Budget has introduced significant changes to the capital gains inclusion rate in Canada, which will impact the real estate sector. The key changes are:

Increase in capital gains inclusion rate

The inclusion rate will increase from 50% to 66.67% for capital gains realized by corporations and trusts on or after June 25, 2024. For individuals, the inclusion rate will increase to 66.67% for capital gains above an annual threshold of $250,000. This means that individuals will pay more tax on their capital gains, making it more expensive to sell investment properties.

Impact on market segments

The changes will result in a higher tax rate on capital gains from the sale of real estate properties, including:

Investment properties (rental properties, condos, etc.)

Cottages and vacation homes

Flipped properties (properties bought and sold quickly for a profit)

Primary residences (in certain situations, such as if the property was previously rented out or used for business purposes)

Examples:

John purchased a rental property for $500,000 and sold it for $749,000. His capital gain is $249,000. Because the gain is less than $250,000 he will pay tax on 50% of the gain, which is the same as the previous tax.

Sarah purchased a cottage for $300,000 and sold it for $1,000,000. Her capital gain is $700,000. Under the old rules, she would have paid tax on 50% of the gain ($350,000). Under the new rules, she will pay tax on 66.67% of the gain ($462,000).

Planning opportunities

Taxpayers may consider:

Accelerating the realization of capital gains before June 25, 2024, to avoid the higher inclusion rate

Using the $250,000 annual threshold for individuals to minimize tax liability

Utilizing the lifetime capital gains exemption for qualified small business corporation shares and qualified farm or fishing property

Considering a tax-deferred rollover for qualified small business corporation shares and qualified farm or fishing property

Spreading out capital gains over multiple years to minimize tax liability

Transferring properties to a spouse or children to utilize their lower tax brackets

Impact on overall real estate market

The changes may lead to:

An increase in property sales before June 25, 2024, as taxpayers seek to avoid the higher inclusion rate

A potential slowdown in the market after June 25, 2024, as the higher inclusion rate takes effect

Increased demand for tax planning and advice from real estate professionals and tax experts

A shift towards more tax-efficient investment strategies, such as investing in registered accounts or using tax-deferred exchanges

Exemptions and reliefs

The new rules provide some exemptions and reliefs, including:

The annual $250,000 threshold for individuals

The lifetime capital gains exemption for qualified small business corporation shares and qualified farm or fishing property

Tax-deferred rollovers for qualified small business corporation shares and qualified farm or fishing property

The principal residence exemption (PRE) for primary residences

The ability to claim a capital loss to offset capital gains

Frequently Asked Questions

How do the new capital gains rules affect my primary residence?

The principal residence exemption (PRE) still applies, but the new rules may affect the tax implications if you previously rented out or used your primary residence for business purposes.

Can I still claim a capital loss to offset capital gains?

Yes, the ability to claim a capital loss to offset capital gains remains unchanged.

How do the new rules affect my business or investment strategy?

The new rules may affect the tax implications of your business or investment strategy, and you should consult with a tax professional or financial advisor to determine the best course of action.

What is the annual threshold for individuals, and how does it work?

The annual threshold is $250,000, and it means that individuals will not pay tax on the first $250,000 of capital gains. Any gains above this threshold will be subject to the higher inclusion rate.

Can I transfer my property to a family member to avoid the higher inclusion rate?

Yes, but this may trigger a deemed disposition, and you should consult with a tax professional or financial advisor to determine the best course of action.

How do the new rules affect my estate planning and will?

The new rules may affect the tax implications of your estate planning and will, and you should consult with a tax professional or financial advisor to determine the best course of action.

What is the deadline for realizing capital gains to avoid the higher inclusion rate?

June 25, 2024

Frank Sinatra's Desert Hideway | "Villa Maggio"

A secluded and private escape, which Frank Sinatra personally helped design and build, Villa Maggio offers commanding views of the mountains and valleys, three buildings, a lighted helipad, and 7.5 acres of land. Sinatra’s choice for the name of the estate references a character he won an Oscar for in From Here to Eternity. His directions to Architect Ross Patton reflect a need to provide high-profile guests, including members of the Rat Pack, with the ultimate in luxury and comfort as well as the utmost in privacy and security.

In selecting a location, Sinatra opted for a granite mountaintop overlooking Palm Springs and the Coachella Valley to take advantage of the endless views and the fact that the 4,300 foot elevation provides a more comfortable, temperate climate than the desert valley below. The views are on full display from a variety of locations within the compound: the tennis court, pool and spa, formal dining room, and numerous decks. As a backdrop for the majority of the estate, the vistas are totally surreal and could easily be used by the local tourism board for advertising purposes.

A masterpiece with a rustic, Mid Century-Lodge style design, the designer incorporated wide overhanging eaves to make being outside on the numerous view decks a pleasurable experience. Well-placed eaves provide shade for the three main buildings, which include a five bedroom main house with five and a half bathrooms, a guest home with a separate generator, well and water tower, and a pool house that was ahead of its time in its planning, design and execution. Warmed by a massive stone fireplace, the pool house includes two bedrooms and two saunas, a kitchenette and a built-in fire pit with a large zone for entertaining.

With an extensive use of locally-sourced materials, including natural stone and hardwoods, this residence adds beauty to the surrounding environment. Hardwood floors, numerous fireplaces, and vaulted ceilings with exposed wood beams give the estate an understated and relaxing, down-to-earth atmosphere; the commercial grade appliances in the main home’s two full kitchens make it more than ready for guests and the demands of modern life.

Recognized as the quintessential entertainer, Sinatra ensured the guest house was on par with the resorts and luxury hotels where his friends were accustomed to staying. The two-story guest home offers three guest suites, each with a private view deck, stone fireplace, kitchenette, and bathroom. If the walls could talk, a likely topic of conversation would have to be about who traveled in the secret passage between two of the guest house bedrooms.

The same qualities that Sinatra sought to incorporate in the original design still resonate with modern celebrities and power players: ease of access, security, privacy, resort-style amenities for entertaining, and space from the neighbors. Set on a secluded, 7.5 acre lot at the end of a gated, private drive, the estate is located within 20 minutes of the heart of Palm Desert, with its high-end boutique shopping and numerous fine dining options on El Paseo. Palm Springs International Airport is also just 26 miles away, a short jaunt by helicopter.

The character and style of the home have been lovingly preserved and maintained for the next owner to enjoy. With a total square footage of approximately 6,428, which includes eight bedrooms, 12.5 bathrooms, and nine fireplaces, this estate offer something for everyone and an unprecedented opportunity to own a piece of history.

Prestige Magazine Spring 2024

Hot off the press is the Spring 2024 issue of Berkshire Hathaway HomeServices Prestige magazine.

This issue spotlights remarkable properties from across the network, while exploring the draw of luxury homes with million-dollar views, the rich culture of New Orleans, the evolution of garages into luxury havens, and the vibrant transformation of Washington D.C.

Read Latest Issue

House hacking in 2024. A unique opportunity.

As interest rates have risen over the past couple of years, the headlines have overwhelmingly focused on the impact they have had on monthly payments. While prices did pull back temporarily, they have generally remained steady as higher interest rates have been offset by record immigration and a historic lack of inventory.

Hidden in all of this noise is that the current market conditions, and temporary pause in price increases, have created an amazing and lucrative opportunity for a specific type of buyers. The house hackers.

House hacking is when you rent out a portion of your property in order to help outsource your monthly costs. This can be as simple as renting a room in a condo, or can expand into renting out multiple units in a house.

House hacking is one of the safest and most effective ways of building long term wealth because it allows homeowners to outsource their debt while also giving them the flexibility to pick and choose when to maximize rent vs lifestyle.

House Hacking Examples

1. A single family house with a basement apartment. This is the most common form of house hacking. Basement apartments are cost effective to build and generate strong rents, while leaving the homeowner to enjoy near maximum use of their space.

2. A single family house with a laneway house or garden suite. Similiar to basement apartments, laneway houses allow the homeowner to enjoy maximum use of the main property. While constructing a laneway house is more costly than a basement apartment, the return on investment and immediate cashflow is still strong. The added benefit of a laneway house is that it is a fully detached dwelling and provides maximum privacy for the homeowner.

3. A multi unit house. These type of properties offer the maximum financial benefit for a homeowner. A fourplex home with a laneway house can create a "live for free" scenario where the tenants cover all of the monthly expenses for homeowner. The homeowner has the flexibility to choose which unit to live in depending on the amount of income they wish to generate. For example, they could live in the laneway house and rent out the main house if their focus is on lifestyle. Conversly, they could live in the basement and rent out the rest of the property if their priority was to maximize revenue.

Who should be house hacking now?

Those who own a condo or house and are looking to upsize. The rise in interest rates over the past couple of years provided a pause in what had been an extended period of explosive growth in home prices. In addition to this, the rise in construction costs combined with slower price growth has pushed flippers and speculators out of the market. This has created a unique opportunity for end users to purchase excellent properties at common sense prices.

Parents who want to responsibly buy a home for their kids. A 2021 study conducted by CIBC found that gifting for downpayments exceeded $10 Billion in 2021. The average gift amount in Toronto was $130,000 for first time buyers and $200,000 for move up buyers. While these gifts cetainly help buyers close on properties, they are often still left with large mortgages and high monthly payments. House hacking is a way to help your kids upsize into their future home, while also leaving them house rich. By outsourcing part, or all of their monthly costs, it will help them build long term wealth while leaving them with the flexibility of expanding their own living space as they feel more comfortable doing so. Remember there is a different between what you can afford and what you should afford.

People who are looking to buy a property with family or friends. (Co-buyer) As real estate prices have skyrocketed across the GTA in recent years, it has made the dream of homeownership seem impossible for many. Co-buying is a solution that will without question see a massive increase in popularity in the years ahead. Purchasing a multi-unit house with a friend or family member presents a myriad of advantages for individuals seeking both financial stability and collaborative living arrangements. Firstly, the cost-sharing aspect allows buyers to pool resources, making homeownership in the city's competitive real estate market more accessible. Shared responsibilities for mortgage payments, property taxes, and maintenance costs lighten the financial burden on each co-buyer. Additionally, the potential for rental income from the multiple units provides a steady stream of revenue, contributing to mortgage repayment and overall investment returns.

Mistakes to Avoid

Timing the market to maximize your current property. Generally speaking, while the value of your current property might not be at its peak price, if you are moving up to a more expensive property, the discount you will receive on the purchase of the new property will outweigh any perceived loss on your current one.

Don’t be afraid of a larger mortgage. If you have tenants helping you pay it, you are actually outsourcing your debt, and this is one of the fundamentals of building wealth. While upsizing and taking on a larger mortgage (especially at the current rates) may be intimidating, let the numbers and common sense guide you. Depending on the property you buy, and how much of it you rent, you may pay less every month than what you do currently, and with the right property, you could pay nothing at all.

Being closed minded about co-buying. At the end of the day, real estate is almost always as much about investing as it is about finding a place to call home. The saying that "fortune favours the bold" wasn't created by accident. The most successful people in the world all have business partners. In fact, almost everyone in world has business partner in the form of spouse. So why is it that when it comes to buying a property, it's either all ours or nothing? Co-buying allows people to potentially enter the market sooner (at lower prices) as well to offset their monthly costs. With the ability to build laneway houses up to 1700 square feet, multiple owners can still create a detached and private living environment where both owners enjoy maximum benefit from the property.

So why is now the time to house hack?

Simply put, the numbers just make sense… regardless of the interest rates.

There are excellent properties selling at attractive prices every single week. As a buyer in this market, you can find a multi unit property where you can live in one of the units and rent out the others. Additionally, you can find an attractive single family home with the ability to build a laneway house for a fraction of buying two separate houses.

These scenarios allow buyers to reduce and sometimes even eliminate their monthly living expenses. In addition, outsourcing debt is one of the most powerful tools to building long term wealth.

In our current market, a condo that is purchased as an investment, would not have it's monthly costs covered by the tenant. Conversely, you can absolutely find a multiplex house that is cash flow neutral or even positive. Moreover, while a condominium can either function as the owner's residence or be rented out, it cannot simultaneously fulfill both roles. In contrast, a multiplex house offers the added advantage of serving as both a home for its owner and an investment vehicle. This is where the opportunity lies.

As a final thought, house hacking doesn't need to be looked at as a permanant living arrangement. It allows homeowners to be flexibile and to adapt their living arrangements to suit their situation and lifestyle. It also provides ongoing financial security and can contribute substantially to your long term wealth.

Government incentives for investors.

When it comes to investing in real estate, the best opportunities are often driven by government policy. Whether it’s through financing, tax benefits or other regulations, the government often shows investors exactly where they want them to focus.

Over the past couple of years, the government has introduced a number of initiatives that have made investing in the "missing middle” one of the most lucrative investment opportunities we have seen in years.

Additionally, end users who are looking offset their mortgages payments by renting our part of their property (house hackers), will equally benefit from these programs and incentives.

What is the missing middle?

Simply put, Toronto is filled with residents who live in high density housing (condos) and as they grow older and build families they want to move into more low density housing (houses). In the past, the traditional path has been for these residents to either progressively upsize within the city or for them to move outside of the city to find larger and more affordable homes.

In recent years, we have witnessed our population boom, seen significant increases in both purchase and rental prices, and have had older home owners staying in their houses for longer. All of these factors have lead to a massive lack of inventory for low density housing within the city of Toronto. Welcome to the “missing middle”.

The demand for this housing type is immense and the supply is almost non existent. This is where the opportunity lies.

How is the Government helping?

Over the past couple of years the government has quietly introduced a number of initiatives, that when combined together, make this one of the best investment opportunities that we have seen in years. (In our opinion of course)

Laneway Houses & Garden Suites:

In 2018 the city of Toronto officially allowed laneway houses to be built as secondary dwellings and this initiative has since been expanded in many jurisdictions outside of Toronto. These dwellings have benefited both homeowners and renters by creating profitable income streams for homeowners as well as low density living spaces in desirable neighbourhoods for renters. In addition, these dwellings can be added to existing properties to help investors offset interest rate increases or to simply increase the value of those investments.

Generally speaking, a laneway house costs about $350,000 - $400,000 to construct. If you were to finance the entire build cost at today's interest rates, that would equate to about $2000 - $2200 in monthly mortgage payments. When you compare that to the approximately $4000 that they generate in rent, it's easy to see how these dwellings can help homeowners and investors generate long term wealth.

“As of Right” 4 Unit Zoning:

In April 2023 the city of Toronto approved “as of right” zoning for 4 plexes all across the city. This means that any property in the city can be turned into a 4 plex without any special permission. This new bylaw not only creates the possibility for more multiplex (low density) inventory in the city, but it also creates certainty for investors and significantly speeds up the approval and building process.

This provision benefits investors by allowing them to both maximize rental returns for their properties (small units rent for more on a per square foot basis) as well as allowing them to reduce their rental risk by diversifying their tenant pool (Not putting all their eggs in one basket).

Development Charge Exemption:

Prior to June 2022, anyone looking to legally add a unit to a property would have had to pay a development charge tax of $50,000 for each 1 bedroom and $80,000 for each 2 bedroom. This means for anyone trying to convert a single family home into a 6 bedroom triplex (3 x 2 bedrooms) would have had to pay $160,000 in development charges alone. In June 2022, the city of Toronto removed these development charges for up to 4 units in a property. This change directly aligns and compliments with the 4 unit “as of right” zoning mentioned above, and is further evidence of the government’s motivations and goals.

In addition to the above, development charges have also been removed for laneway houses and garden suites.

Combined together, this policy change has create hundreds of thousands of dollars in potential savings when compared to years past.

No HST on New Builds:

In 2023, both the Federal and Provincial governments announced that HST would not apply to the construction of new rental housing of at least 4 units. Typically, when building a rental property, an investor will have to pay HST on both their trades as well as on the building supplies. Since landlords do not collect HST on residential rents, there is no way for them to offset or recoup those costs.

This new program now solves that equation and results in tens, if not hundreds of thousands of dollars worth of savings for investors.

MLI Select Financing:

Simply put…this program is special. If you take one thing from this blog, it’s that you should take the time to fully understand what the MLI Program is and the benefits it can bring to you as an investor. It’s a very unique financial vehicle that has the ability to both reduce the risk and massively increase the value of any real investment.

The MLI program can be used to finance properties with a minimum of 5 units. In Toronto, this can be achieved by combining a 4 plex (which is now “as of right”) with a laneway house or garden suite. Below are the unique benefits of the MLI Select program:

90% Purchase and Construction Financing.

Low Fixed Rate

50 Year Amortization

Limited Recourse Loan

No Ongoing Income Barriers

Conclusion:

Combined together, the government's recent policy changes have create a unique and lucrative opportunity for investors. Their actions have made clear that the "missing middle" is the exact type of real estate investments that want investors to focus on.

As with all government policies, these benefits should be looked at as temporary and the most proactive investors will be the ones that benefit the most from them.

When you combine the temporary pause in price increases with the potential to save hundreds of thousands of dollars in development charges and HST payments as well as to power of the MIL select program, 2024 has the ability to one of the best investment opportunieis in years.

The best mortgage strategy for 2024.

Your mortgage strategy forms the foundation for the purchase of any home or investment. At the end of the day, you are really buying a payment as much as you are buying a property. The right financing decision can literally cost or save you tens of thousands of dollars over the term of your loan. While no Realtor, Mortgage Broker or Economist have the benefit of owning a working crystal ball, we can provide guidance, predictions and historical data in order to help you make a more informed financing decision.

According to the Canadian Association of Accredited Mortgage Professionals, nearly 65% of all mortgages in Canada are fixed, when studies have shown that variable rate mortgages have outperformed their fixed counterparts 90% of the time since 1950. This contradiction highlights the importance of truly understanding and educating yourself when making such a major financial decision.

So let's start with the basics.

Since March of 2022, the Bank of Canada has increased rates from a low of .25% to the current 5% rate through a series of 10 rate increases.

For individuals who had locked in with record low, 5 year fixed rate mortgages, they have been unaffected thus far from the spike in rates, and will continue to be until their mortgages are up for renewal.

For those who had chosen variable rate mortgages, they have either seen their payments increase dramatically or seen their principal payments shrink as rates have increased.

So does that mean fixed rates are the right choice in today's market? Probably not for most people.

When it comes to choosing between a variable or fixed rate mortgage, the most simple rule to follow is, when rates are extremely low, lock in your rate, when rates are higher, stick with a variable. Taking the rule even further, when rate increases are on the horizon look to fixed mortgages and when rate decreases are coming, look to variable.

While this is a slight oversimplification of the decision making process, it's also supported by long term data.

Below we will provide you with a information and insights in order to:

1. Help you understand the current state of the market.

2. Provide guidance on the strategies that we believe will work best for buyers in the short and long term moving forward.

How Are Interest Rates Set?

Before we jump into some of the rate predictions for 2024, it's important to understand the difference between what actually drives changes in fixed vs variable rate mortgages. While both rates are ultimately driven by the same economic factors over the long term, in the short term, they are actually set using different mechanisms.

The interest rates for fixed-rate mortgages are typically influenced by the bond market. Lenders tie fixed mortgage rates to government bond yields. When bond yields rise or fall, fixed mortgage rates tend to follow suit. In Canada, the bond yields have come down over the past 6 months (A high of 4.4% to a low of 3.1%) as inflation concerns have started to ease and the Bank of Canada has started to communicate that rate cuts are on the horizon. This in turn has driven fixed rate mortgages lower. As of today, a 5 year fixed rate for an uninsured mortgages (a mortgage with at least 20% downpayment) sits around 5.7% which is down from over 6% last year.

A variable rate mortgage is directly tied to lender prime rates, which in turn are directly affected by the Bank of Canada's (BoC's) benchmark rate. The benchmark rate has been sitting at 5% since the last interest rate increase in July of 2023. For example, the current TD prime rate is 7.35% and the current RBC prime rate is 7.2%. When it comes to actually securing a variable rate mortgage with any bank or credit union, they will typically offer an actual discount to prime. For example, RBC is currently offering prime minus .3 which would create a mortgage rate of 6.9%.

The current outlook for the interest rates in 2024 and beyond.

As we look ahead and try to make some educated predictions for interest rates in 2024, it's important to note that we aren't just pulling random numbers out of a hat. In fact, the Bank of Canada tells us more or less exactly where we are going to end up with interest rates... eventually. The long term goal is for the Bank of Canada rate to align with the rate of inflation, which in Canada has a target of 1% - 3%.

So where does that leave us now? As of the writing of this article, the latest predictions from top economists are for an initial rate cut of .25% in June or July.

In CIBC's recent 2024 forecast, they are anticipating a total of 1.25% in cuts by the end of 2024 and a recent TD Report predicted the Bank of Canada policy rate ending up at 2.25% by the end of 2025.

In short, it's only a matter of time before we start to see continued rate cuts and it's almost universally agreed that we are close to the end of this high interest rate cycle.

How potential rate cuts will impact variable and fixed mortgages.

Using the above predictions as a base allows us to run some scenarios comparing current fixed vs variable mortgage options.

Option 1 - 5 Year Fixed at 5.7% - $1 Million Mortgage

Since this is a fixed rate mortgage, the math is simple. Your monthly payment over the next 5 years will be $5,762.

After the 5 year term you will have paid $73,772 in principal.

Option 2 - 5 Year Variable at 6.9% - $1 Million Mortgage

To keep this scenario as simple as possible, we are going to assume that the mortgage is 6.9% today but will be 5.7% by the end of the year based on the anticipated rate cuts. This would create an average rate of 6.3% for year one. In year 2 rates will decrease another 1.2 percent which reduce the rate from 5.7% at the start of the year, to 4.5% at the end of the year, with an average of 5.1%. We will then use the 4.5% rate for years 3 to 5.

In this scenario, your monthly payments would be as follows:

Month 1 at 6.9% = $6,521

Month 12 at 5.7% = $5,762

Month 24 - 72 at 4.5% = $5,042

At the end of your 5 year term you would have paid $82,928 in principal.

Comparing the two scenarios, the variable rate option would provide a cost savings of $9206.00 over the term of your loan.

Now in a perfect world, where changes in rates were 100% predictable, the choice would of course be easy, go with the variable. Unfortunately, that's not the world we live in, and so we have to make some educated predictions based on both current and past data.

The historical advantage of variable vs fixed rate mortgages.

Referencing the chart above, we can see that from 2006 to 2022, variable rate mortgages in Canada have demonstrated a notable trend of outperforming their fixed-rate counterparts. The contributing factors to this trend were: 1. the overall decline in interest rates during this timeframe and 2. the economic stability and low inflation Canada witnessed during this period.

Looking further back, a study conducted by York University found that between 1950 and 2000 variable rate mortgages have outperformed fixed mortgages 89% of the time. Importantly, this period covers a number of high inflationary periods in the 1970's and 1980's.

The current market conditions are obviously quite different than they what we have seen over the past 20+ years, yet we do have a couple of important tools that can help guide our future decisions.

Conclusions & Strategy

So what mortgage strategy should you use for 2024? In short, we believe that variable rate mortgages are the superior choice for today's buyers. Not only does the historical evidence overwhelmingly favour these types of loans, but we also believe that there are clear signs that the current high interest rate environment is close to it's end.

In addition to the above, variable rate mortgages offer buyers more flexibility and lower potential penalties should you wish to break your mortgage durring the period of your loan. This includes if you decide to sell or refinance your loan. In contrast, if you lock in a fixed mortgage and rates decrease substantially, the penalties to break the loan in order to refinance will be signficant.

Let Us Help Your Strategize

While this blog is great start for your financing journey, there is no substitute to getting advice directly from an expert. We work with one of the top mortgage teams in Canada who can help provide you with personalized advice based on your unique circumstances. Please reach out to us for a personal introduction!

All about co-buying.

The dream of homeownership in Toronto is a common thread that weaves through the fabric of many individuals' aspirations. As housing prices continue to rise and urban living evolves, co-buying a house emerges as an intriguing alternative to the conventional path of solo condo ownership.

In this blog post, we'll delve into the benefits of co-buying a house in Toronto, shedding light on the advantages over solo condo ownership and exploring creative ways to offset costs.

---

The Power of Partnership: House vs. Condo

Choosing between a house and a condo is a pivotal decision on the journey to homeownership. Co-buying a house with someone else offers several distinct advantages over going solo with a condo.

Space and Privacy: A house provides more space and privacy compared to a condo, making it an attractive option for individuals or families looking for a larger and more personalized living environment. Co-buying allows you to share the financial responsibility while enjoying the benefits of a spacious home.

Shared Costs, Shared Gains: Co-buying enables the sharing of mortgage payments, property taxes, and maintenance costs, significantly reducing the financial burden on each buyer. This collaborative approach often opens doors to larger and more desirable properties that may be financially out of reach for an individual condo buyer.

Long-Term Investment: Houses, as a more scarce asset, tend to outperform condos in terms of appreciation over time. Co-buying a house can be viewed not only as a home but also as a long-term investment that may yield substantial returns.

---

Creativity in Offsetting Costs: Renting Basements and Laneway Houses

One of the compelling aspects of co-buying a house is the potential to offset costs through creative solutions. In Toronto, the ability to rent out a basement or build a laneway house can be a game-changer.

Basement Rental Income: Co-buying a house allows you to maximize the use of space, and renting out a basement can serve as a significant source of additional income. Toronto's diverse rental market can attract tenants seeking affordable and well-maintained living spaces.

Laneway House Potential: Some properties in Toronto may have the potential to build a laneway house, providing an additional dwelling unit separate from the main house. This can be a lucrative option for generating rental income while maintaining the privacy of both co-buyers.

---

Financial Wisdom: Houses vs. Condos

Beyond the immediate advantages, co-buying a house aligns with financial wisdom, especially considering the long-term trends in the Toronto real estate market.

Scarce Asset Appreciation: Houses are considered a more scarce asset compared to condos, as the supply of single-family homes is limited. Over time, this scarcity often results in stronger appreciation, making co-buying a house an investment in both lifestyle and financial security.

Equity Buildup: With mortgage payments contributing to equity buildup, co-buying a house allows you to build wealth over time. This equity can be leveraged for future investments or even renovations to enhance the property's value.

---

Co-buying a house in Toronto presents a unique opportunity to create a shared haven while strategically navigating the city's real estate landscape. The advantages of space, privacy, shared costs, and the potential for creative income generation make co-buying a house an attractive option. As housing prices continue to rise, the wisdom of investing in a more scarce asset becomes apparent, positioning co-buyers not just as homeowners but as shrewd investors in Toronto's dynamic real estate market. Whether you're a first-time buyer or a seasoned investor, co-buying a house may well be the bold step that aligns with both your lifestyle and financial goals.

January 2024 Detailed Market Report

Home sales were up in January 2024 in comparison to January 2023. This annual increase came as some homebuyers started to benefit from lower borrowing costs associated with fixed rate mortgage products. New listings were also up year-over-year but by a lesser annual rate compared to sales. The resulting tighter market conditions when compared to the same period a year earlier, potentially points toward renewed price growth as we move into the spring market.

“We had a positive start to 2024. The Bank of Canada expects the rate of inflation to recede as we move through the year. This would support lower interest rates which would bolster home buyers' confidence to move back into the market. First-time buyers currently facing high average rents would benefit from lower mortgage rates, making the move to homeownership more affordable,” said TRREB President Jennifer Pearce.

There were 4,223 sales reported through TRREB’s MLS® System in January 2024 – an increase of more than one-third compared to January 2022. The number of new listings was also up year-over-year but by a lesser annual rate of approximately six per cent. Stronger sales growth relative to listings suggests buyers experienced tighter market conditions compared to a year ago.

On a month-over-month seasonally adjusted basis, both sales and new listings were up. Sales increased more than listings which means market conditions tightened relative to December 2023.

“Once the Bank of Canada actually starts cutting its policy rate, likely in the second half of 2024, expect home sales to pick up even further. There will be more competition between buyers in 2024 as demand picks up and the supply of listings remains constrained. The end result will be upward pressure on selling prices over the next two years,” said TRREB Chief Market Analyst Jason Mercer.

The MLS® Home Price Index Composite in January 2024 was down by less than one per cent year-over-year in January. The average selling price was down by one per cent year-over-year to $1,026,703. On a month-over-month seasonally adjusted basis, both the MLS® HPI Composite and the average selling price also trended lower.

“While housing market conditions are expected to improve with lower borrowing costs, there are still a number of policy issues that need to be addressed. At the federal level, more reflection on the Office of the Superintendent of Financial Institution (OSFI) mortgage stress test is required, especially to its application at different points in the interest rate cycle. The focus for the Province needs to remain on building 1.5 million new homes. At the municipal level, raising property taxes without consistent support from the federal and provincial governments won’t eliminate Toronto’s structural deficit. Helping first-time homebuyers get into the ownership market will ease movement across the entire spectrum and relieve pressure on the rental market,” said TRREB CEO John DiMichele.

Below you will find detailed Executive Summary reports for each region in TRREB. Each Executive Summary Report includes a map of the included zones and a 17 page summary for each property type (detached, semi-detached, townhomes, condos)The Information / statistics you can find in each Executive Summary Report include:

Data comparing the – 1, 3, 5 and 10 year sales averages.

Stats categories – Sales, New Listings, Active Listings, Average Price, Months of Inventory (MOI), Sales to New Listing Ratio (SNLR)

All 416 Report | Core 416 Report | All 905 Report

Halton Report | Peel Report | Oakville Report | Burlington Report

York Report | Durham Report | Simcoe Report

The BRRRR Real Estate Method: Building Wealth Through Strategic Investment

When it comes to investing in real estate, there is one long term strategy that stands above the rest...the BRRRR method. BRRRR stands for: Buy, Rehab, Rent, Refinance, Repeat. In this blog, we'll explore the key principles of the BRRRR real estate method and how it can be a powerful tool for building long term wealth.

Buy - Strategic Acquisition:

The first step in the BRRRR method is strategic property acquisition. Investors target distressed or undervalued properties with potential for improvement. This phase requires a keen understanding of the market, identifying properties that align with the investor's financial goals and the potential for value appreciation.

Rehab - Adding Value:

After acquiring the property, the focus shifts to rehabilitation. This step involves making necessary improvements to increase the property's value. From cosmetic upgrades to structural enhancements, the goal is to enhance the property's appeal and overall market value, ensuring a profitable return on investment.

Rent - Generating Income:

Once the property is renovated, the next step is to secure rental income. By attracting reliable tenants, investors can create a steady cash flow stream that contributes to covering expenses and financing costs. The rental income is a critical component of the BRRRR strategy, providing financial stability and offsetting the initial investment.

Refinance - Unlocking Equity:

With the property rehabilitated and generating income, the investor can now explore refinancing options. Refinancing involves reassessing the property's value and leveraging it to secure a new mortgage. This step allows the investor to pull out a portion of the equity built through the rehab phase, providing capital for future investments.

Repeat - Scaling the Portfolio:

The true power of the BRRRR method lies in its scalability. Once the property is refinanced and additional capital is obtained, investors can repeat the process with a new property. This iterative approach allows for the continuous expansion of the real estate portfolio, compounding the wealth-building potential over time.

Benefits of the BRRRR Method:

Forced Appreciation: The strategic rehabilitation phase forces appreciation, increasing the property's value and reducing risk by creating immediate equity in the property.

Cash Flow: The rental income generated provides consistent and predicatable cash flow that increases over time. The longer the property is rented, the higher the rental income and the more principal that will be paid off the loan.

Equity Buildup: Refinancing allows investors to unlock built-up equity, providing capital for future acquisitions without depleting personal funds.

Portfolio Diversification: The repetitive nature of the BRRRR method enables investors to diversify their portfolios across multiple properties, mitigating risks and maximizing potential returns.

The BRRRR real estate method is one that has been used by the most successful Realtors in virtually every market on earth. By strategically cycling through the steps of Buy, Rehab, Rent, Refinance, and Repeat, investors can build a robust portfolio, generate reliable income, and position themselves for long-term financial success. As with any investment strategy, thorough research, market understanding, and a calculated approach are crucial to maximizing the benefits of the BRRRR method.

Global Open House Season 5 Episode 1

🍿 Season 5, Episode 1 of our Global Open House series has arrived!

Episode 1 explores stunning properties in Honolulu, Hawaii; Santa Ynez, California; Bradenton, Florida; and Saint Simons Island, Georgia.

2024 Real Estate Trends: Canada, Mexico, and the Caribbean

Reuters recently conducted a poll of 130 international housing analysts, including representatives from property markets in the U.S., Britain, Germany, Australia, New Zealand, and India, which showed that the double-digit housing price declines they anticipated failed to occur, and that they’re upgrading their forecasts for 2024. While some areas did experience price declines in 2023, analysts expect prices to rise in 2024.

For the economies with the fastest house inflation, such as the U.S., Canada, New Zealand and Australia, analysts believe that most central banks are unlikely to cut overnight borrowing rates to retail lenders, and that demand from homebuyers in most Western markets will keep prices higher ensuring affordability remains an issue.

Beginning with the U.S., Realtor.com says housing prices soared with the onset of the pandemic, changing household priorities amid safety concerns. Then, in 2022, mortgage interest rates rose from just over 3% to 7%. Rates wobbled toward 8% in 2023, even while home prices continued to rise, but rates helped reduce sales volume by nearly 19% to 4 million units from the 5 million homes sold in 2022. Heading into 2024, Realtor.com forecasts that market conditions have little changed and that, while mortgage interest rates will ease to 6.5%, existing homeowners still don’t have much incentive to sell, so inventory will remain tight against demand. More than 90% of homeowners with loans have a rate of less than 6% and two-thirds have a rate under 4%. Corelogic.com forecasts that 2023 will end with a 4.7% rise in home prices, but that price growth will slow to 2.9% in 2024.

Canada

In Canada, the Canadian Real Estate Association reported that housing sales are still in a downward trend, falling by 5.6% in October 2023. Home sellers are waiting until spring 2024 to list their homes for sale as homebuyers “hibernate” for the winter, while new listings are at a 20-year low. The average Canadian home price was around $656,000 in October, according to CREA, an increase of 1.8% year-over-year.

From a low of 3.1 months of listing supply in May 2023, inventories have risen to 4.1 months’ supply, still below the long-term average for Canada of five months’ supply on hand. The sales to new listings ratio—a metric that compares the number of homes sold in a given time versus the number of new listings—slipped from 67.9% in April 2023 to 49.5% in October—a 10-year low. A ratio around 50% indicates a balanced market between homebuyers and sellers, a higher number suggests a seller’s market and a lower number means a buyer’s market. Canada’s long-term average is about 55%.

Like the United States, Canada is waiting for its central bank, the Bank of Canada, to either increase interest rates again or make its first cut to overnight borrowing rates, making it difficult to predict the spring market to the end of 2024. The Canada Mortgage and Housing Corporation (CMHC) predicts that after home prices hit bottom for this market cycle, that they’ll start rising again in 2024 to an average of $694,196 and $746,410 in 2025. With inflation and higher interest rates still an issue, the CMHC doesn’t expect prices to revisit where they were before the onset of the pandemic in 2020.

Mexico

In 2023, Mexico’s residential real estate market is estimated to reach $13.93 billion and rise to $17.07 billion by 2028, according to Mordor Intelligence. Mexico is a well-known tourist and vacation homebuyer destination, which is producing higher demand for resort and second home properties. Young people are also demanding a place to live, with those under 30 years of age (55% of Mexico’s total population) driving development. One titillating stat from Numbeo shows rental properties in Mexico offer gross rental yields ranging from 6.3% to 9.0%.

TheLatinInvestor.com recommends certain considerations for any foreign property investor. The first is the country’s stability. According to the Fragile States Index, Mexico’s stability score is 69.8, which places it in the “warning” or mid-range category, compared to Canada’s enviable score of 18.9 and the United States at 45.3, but stability is improving as the government implements economic reforms and continues to reduce crime and violence. Mexico has also worked to strengthen diplomatic ties with other countries.

The second consideration for investors should be a country’s economy. Mexico is expected to experience a 3.3% inflation rate for the next five years, which is a good hedge for property owners. Property values and rental rates will increase, which all but assures investors of making a profit. The International Monetary Fund predicts that Mexico’s gross domestic product will end 2023 with a gain of 1.8%, and in 2024 will go slightly lower to 1.6%. Over the next five years, GDP is expected to average 1.7%.

The Caribbean

Gorgeous white sand beaches, sparkling turquoise waters, lush tropical landscapes, year-round sunshine, and warm temperatures make the Caribbean one of the most attractive places on earth for luxury vacations, second homes and investment property.

Statistica research concludes that the value of the real estate in the Caribbean will reach $1.70 trillion in 2023, and values will rise 5.0% annually, resulting in a market volume of $2.17 trillion by 2028. Most of this will be investments in upscale residential real estate by international buyers, who feel confident because of the Caribbean’s “underlying macroeconomic factors,” including stable economic growth in recent years, favorable government policies, and a shift in preferences for more luxurious properties. Developers are focusing on high-end projects to cater to this wealthy sector.

Explains LatinCarib.com, there are numerous incentives for foreign investment. Foreign buyers can get free title to their real estate, and there are also tax incentives for investors and a streamlined property acquisition process has also made a difference.

The Bahamas, once a territory under Great Britain’s rule until 1973, is an independent self-ruled country. There is no income tax, capital gains tax or inheritance tax, but there are substantial transaction costs between 9.1% and 25.5%. There are limitations, however, for foreign investors if the property they want to buy exceeds two acres, is being purchased to rent out, or is for commercial development.

Incentives are similar in Aruba, with foreigners able to buy property easily with about 40% down. A territory of the Netherlands, the 69-square-mile island sits outside of the hurricane belt about 15 miles north of Venezuela in the southern Caribbean and boasts a somewhat arid climate.

The Cayman Islands is a self-governing British Territory composed of three islands totaling 102 square miles, and enjoys the highest standard of living in the Caribbean, as well as one of the highest in the world. Like other areas affected by high interest rates, rising prices, and reduced construction, homebuying demand from locals is hampered, but it remains robust for foreign investors. Projected GDP growth is 2.3% in 2023, but is expected to decelerate to 1.6% in 2024. Growth is forecasted at 2.0% in 2025 and 2.2% in 2026. Real estate growth is fractional at 0.2% in 2023, and is expected to contract by 1.2% in 2024, before rebounding by 2.0% in 2025 to 2026.

The Caribbean islands are the closest formation to Florida, which means that the island economies are closely linked to the U.S. economy. Most foreign investors are American, Canadian, and European.

These forecasts for Canada, Mexico, and the Caribbean are subject to change. According to the National Association of REALTORS®, the biggest factors to impact real estate sales and investment are global unrest, economic uncertainty, and eroding home affordability.

Global Real Estate Trends in 2024: The Bahamas, Cayman Islands, and Aruba

High inflation and borrowing costs are impacting real estate all over the world, but the never-ending desire for homeownership continues to drive home sales despite weakening economics and other factors, like supply chain interruptions, labor shortages, and lack of available inventory.

The tourism industry was severely wounded by the pandemic, and the Caribbean islands were no different. These islands are located in the Caribbean Sea, south and east of the U.S. and Mexico and north of Latin America. They are widely considered to be among the most beautiful places in the world and a major tourist destination, and their proximity to the United States, Canada, Mexico, and South America make the islands extremely popular with cruise ships, honeymooners, and other tourists. Tourism’s economic importance is measured in “arrivals,” i.e., people visiting a location by boat or plane.

Since the 1990s, tourism in much of the Caribbean has declined, due to the global financial crisis in 2008-2009, weak gross domestic product and high unemployment. Frequent tropical storms and hurricanes also contribute. Tourism is notoriously vulnerable to economic shocks from wealthier and more advanced economies, so when world economies decline, so does tourism, which in turn impacts economic growth in other sectors of the local economy, such as “agriculture, trade, transportation, communications, construction, and entertainment.”

Another factor impacting Caribbean tourism is Cuba. The Cuban Revolution in 1959 caused the United States to close tourism to the country in 1963. Until then, Cuba was the destination of approximately half of U.S. Caribbean tourists. By 1968, tourist arrivals to The Bahamas grew from 150,000 in 1954 to more than a million. Mexico also developed Cancun as a tourism destination. Eventually, Cuba was left with only 3% of the tourism market in the Caribbean.

In 2014, the U.S. relaxed travel restrictions to Cuba in 12 categories, short of allowing tourism to resume, but it was enough to give Cuba a boost in arrivals to 21.8% of the market, including a 6.6% rise in U.S. arrivals. Canadian tourists account for 40% of Cuba’s 3 million visitors. In Aruba, The Bahamas, Cancun, Jamaica, and St. Kitts and Nevis, U.S. tourists constitute 60% of total arrivals. European tourists have fallen by 25% since 2008, but Canadians are making up the shortfall.

The Caribbean tourist market doesn’t come without risk. An average one-week holiday on a Caribbean beach is higher in cost than other beach destinations, with the exceptions of Cuba and the Dominican Republic, which could explain the decline of European and other visitors. Should the U.S. lift all travel restrictions to Cuba, tourism numbers in the Caribbean could change rapidly, making other countries and their islands even more dependent on the U.S. and Canada. One estimate is that U.S. tourism to Cuba could increase from 3 million to 5.6 million annually. While new tourists could account for some of these numbers, it’s safe to say that Cuba would have increased arrivals while other islands in the Caribbean could lose many tourists.

Another major risk to the Caribbean is its vulnerability to natural disasters. Fifteen out of the top 25 countries worldwide with the most tropical cyclones per square kilometer are in the Caribbean islands. Hurricanes can destroy their economies, with tourist arrivals slashed by 25% to 50% the month after and as much as 90% in the year following a severe disaster. Hurricane “season” is typically between June 1 and November 30 each year.

Why is tourism so important to Caribbean real estate? Beachfront is limited and becoming more so. Since the 1990s, cruise lines have purchased seven islands in the Caribbean to give their tourists a private, safe beach experience. On some islands, protests have begun against the building of luxury resorts that favor foreign investment over local citizens, and impacts marine life, water usage and beach access. One source called luxury resorts the tourism of the future, as they bring in more revenue than hotels. Tourism is also important to housing sales, as visitors may love an island so much that they buy a home there.

Statista.com reports that real estate in the Caribbean is under significant development and growth and it’s also attracting homebuyers. The region has more than 7,000 islands, reefs and cays, and it’s vast enough that the island countries have different weather, economies, legal systems, cultures and politics. With 30 different countries and territories, they also have different homebuying processes for foreigners. English-speaking countries Antigua, Barbados, and St. Lucia follow English law. French-speaking countries St. Barts, St. Martin and Martinique follow French law. Antigua/Barbuda, the Dominican Republic, Granada, St. Kitts/Nevis, and St. Lucia offer citizenship by investment to expats—a second citizenship in exchange for a financial contribution or an investment in real estate.

Because of the relative ease of becoming a property owner in the Caribbean, expats, second-home buyers, and investors are taking aim at the Caribbean, with its gorgeous stretch of clear waters, white sand beaches, balmy weather, and small islands ideal for retirement or second homes.

According to KnightFrank.com, the Bahamas is an ideal place to buy a luxury home. It’s a diving paradise only an hour’s flight from Miami, and there are no restrictions on foreign homebuyers. Property owners apply for an annually renewed Home Owners Resident Card, with those buying property valued at $500,000 and above given priority in permanent residence applications. While tourism is the number one economic driver, a fifth of the Bahamas GDP is in financial services. The Bahamas also has the third-largest shipping registry in the world.

The Cayman Islands is composed of three islands and is internationally known for having some of the most beautiful beaches and island scenery. It’s a politically and economically stable autonomous British Overseas Territory made famous as a tax haven for wealthy investors and businesses. The Cayman Islands has no inheritance tax, income tax, property tax, or capital gains tax.

Aruba is known for its incredible trade winds, making windsurfing and kite surfing among many activities for tourists and residents. Its Dutch heritage gives the island a unique charm with notable architecture. Aruba offers housing at all price levels, from modest apartments to luxury villas, with no restrictions to international homebuyers.

For those interested in investing in a Caribbean home, there are many opportunities, both affordable and expensive. All it takes is a visit and some research. And about those hurricanes? New technologies are making it possible for homeowners to live more safely with impact resistant windows, roof reinforcements, new materials, water diversion, and much more.

2024 BHHS Ski Report

⛷ 2023 was a challenging year for the local ski community. Our 2024 Ski Report will help you plan and prepare to ensure you maximize your time on the slopes year after year. We provide insight into some of the world’s most esteemed ski resorts as well as an overview of their real estate markets.

✅ Montreal, Quebec

✅ Aspen, Colorado

✅ Big Sky, Montana

✅ Lake Como, Italy

✅ Park City, Utah

✅ Sun Valley, Idaho

✅ Vail, Colorado

👉 Discover the unique attributes that make each destination popular—as well as up-to-date market facts, tips for securing your dream home, and what 2024 and beyond has in store for these locales.

View the Report

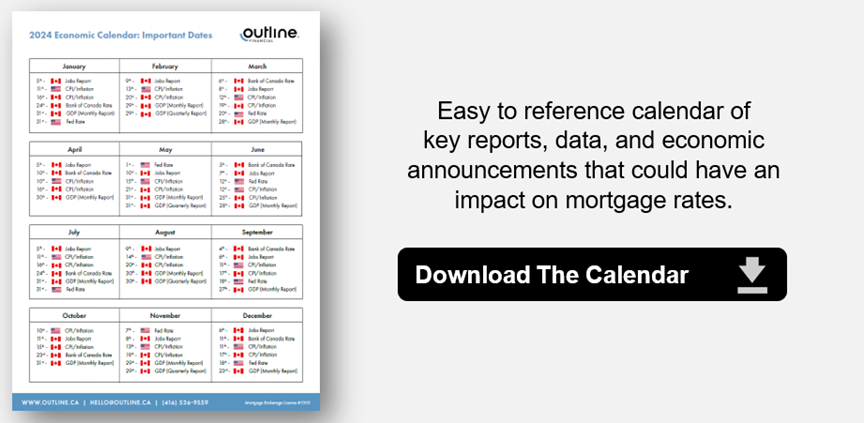

2024 Economic Calendar: Important Dates

Wondering where rates are headed in 2024? While no one has a crystal ball, there are certain dates that can cause waves in the mortgage market. To help calm the waters, we’ve prepared a 2024 economic calendar with key dates of importance. While we haven’t included every date, we are trying to highlight the most relevant that could impact both fixed and variable rates, as well as the overall mortgage market.So what reports & announcements have we included and how can they impact interest rates? Please refer to a quick summary below:

“Bank of Canada Rate” – Bank of Canada Meeting / Rate Announcement Dates: The Bank of Canada meets 8 times spread across the year where they provide an update on the economy, and announce any updates to their Overnight rate. The Overnight rate directly affects the Prime rate and Variable rate mortgages, and could indirectly affect fixed rates if changes are different from market expectations.

“Fed Rate” – US Federal Reserve Meeting / Rate Announcement Dates: Similar to the Bank of Canada Rate updates, the US Fed updates their Reserve rate. Although there is not a direct link to our Prime Rates, changes by the US Fed will influence the Bank of Canada as well as Fixed rates by impacting Bond Yield performance.

“CPI / Inflation” = Consumer Price Index (Statistics Canada / US Bureau of Labor Statistics): These are monthly reports on how inflation was for the previous month. Included is a comparison to the past month as well as the previous year. These occur in both Canada and the US. This is a key metric, where we the central banks want to see inflation come down to a certain range (target is 2% in Canada). As inflation comes under control, we will likely see the Bank of Canada reduce their Overnight rate from the current 5% as of the time of writing. Fixed rates could also see some trends downward if we see inflation cooling trends continue through 2024 & 2025.

“GDP” = Gross domestic product, income and expenditure (Statistics Canada): GDP stands for Gross Domestic Product, and is a measure of Canada’s economic performance. If we see growth cooling this may mean we’re headed for recession; in which case we may see bond yields drop potentially leading to lower fixed rates. If GDP strengthens unexpectedly, this will likely mean a surge in Bonds yields and subsequently fixed rates could rise.

“Jobs Report” = Labour Force Survey (Statistics Canada): These reports look at both unemployment and labour wage inflation. Labour wage is a key metric for future overall inflation, and so the results could impact Bank of Canada decisions on whether sustained inflation-combating measures are needed or not.

We hope you find the above information and the calendar helpful. Should you have any questions, please don’t hesitate to reach out to is and we will connect you with a top mortgage professional.

2023 Year In Review Market Report

In this first edition of the Monthly Outline for 2024, we recap 2023 and look at what might be in store for 2024. In addition to the usual Monthly Mortgage & Stats Outline reports, we are very pleased to include the following additional items (full details and links are included later in the email)

Bank of Canada's Rate Announcement: Commentary & Links

2024 Economic Calendar: Key Dates to Know!

Tax Time & Mortgages Guide: A Critical Combination

At the bottom of this post you will find detailed Executive Summary reports for each region in TRREB. Each Executive Summary Report includes a map of the included zones and a 17 page summary for each property type (detached, semi-detached, townhomes, condos)The Information / statistics you can find in each Executive Summary Report include:

Data comparing the – 1, 3, 5 and 10 year sales averages.

Stats categories – Sales, New Listings, Active Listings, Average Price, Months of Inventory (MOI), Sales to New Listing Ratio (SNLR)

Please find below the links to this month's special edition of the Mortgage & Economic Outline Report and accompanying video. Topics covered within this report include:

Report Contents:

Bank of Canada Rate Announcement & Analysis

Major Banks’ Overnight Rate Forecast for 2024 and 2025

Interest Rate and Home Price / Sales Correlation

Bond Yields Have Dropped Since October – Why it matters

Renew Crisis Ahead – Or more smoke than fire?

A Deep Dive on Condo Supply – Opportunities ahead?

Bank of Canada Leaves Rate Unchanged

On January 24th, the Bank of Canada once again held its overnight rate at 5.00% for the 4th consecutive meeting (the last increase was July 2023).We’re cautiously optimistic that the next move will be downward as inflation begins to ease across the economy. The Bank of Canada stated: “The Bank expects inflation to remain close to 3% during the first half of this year before gradually easing, returning to the 2% target in 2025”.While the Bank “is still concerned about risks to the outlook for inflation”, their explicit statement from December that the Bank “remains prepared to raise the policy rate further if needed” was not included in this announcement. This potentially signals a shift from whether interest rates are high enough, to how long until they can begin to be lowered.The next Bank of Canada meeting is on March 6th, 2024.Are you looking to make a purchase in the next 30 to 90 days? Over the past three months, bond yields have fallen dramatically in anticipation that the Bank of Canada may be done raising rates. The impact? Fixed mortgage rates have also fallen. If you are interested in discussing your options, please reach out to us today for more information.

Link - January 2024 Bank of Canada Monetary Policy Report

Link - Jan 24, 2024 - Bank of Canada Press Release

Key Dates to Know!