Government incentives for investors.

When it comes to investing in real estate, the best opportunities are often driven by government policy. Whether it’s through financing, tax benefits or other regulations, the government often shows investors exactly where they want them to focus.

Over the past couple of years, the government has introduced a number of initiatives that have made investing in the "missing middle” one of the most lucrative investment opportunities we have seen in years.

Additionally, end users who are looking offset their mortgages payments by renting our part of their property (house hackers), will equally benefit from these programs and incentives.

What is the missing middle?

Simply put, Toronto is filled with residents who live in high density housing (condos) and as they grow older and build families they want to move into more low density housing (houses). In the past, the traditional path has been for these residents to either progressively upsize within the city or for them to move outside of the city to find larger and more affordable homes.

In recent years, we have witnessed our population boom, seen significant increases in both purchase and rental prices, and have had older home owners staying in their houses for longer. All of these factors have lead to a massive lack of inventory for low density housing within the city of Toronto. Welcome to the “missing middle”.

The demand for this housing type is immense and the supply is almost non existent. This is where the opportunity lies.

How is the Government helping?

Over the past couple of years the government has quietly introduced a number of initiatives, that when combined together, make this one of the best investment opportunities that we have seen in years. (In our opinion of course)

Laneway Houses & Garden Suites:

In 2018 the city of Toronto officially allowed laneway houses to be built as secondary dwellings and this initiative has since been expanded in many jurisdictions outside of Toronto. These dwellings have benefited both homeowners and renters by creating profitable income streams for homeowners as well as low density living spaces in desirable neighbourhoods for renters. In addition, these dwellings can be added to existing properties to help investors offset interest rate increases or to simply increase the value of those investments.

Generally speaking, a laneway house costs about $350,000 - $400,000 to construct. If you were to finance the entire build cost at today's interest rates, that would equate to about $2000 - $2200 in monthly mortgage payments. When you compare that to the approximately $4000 that they generate in rent, it's easy to see how these dwellings can help homeowners and investors generate long term wealth.

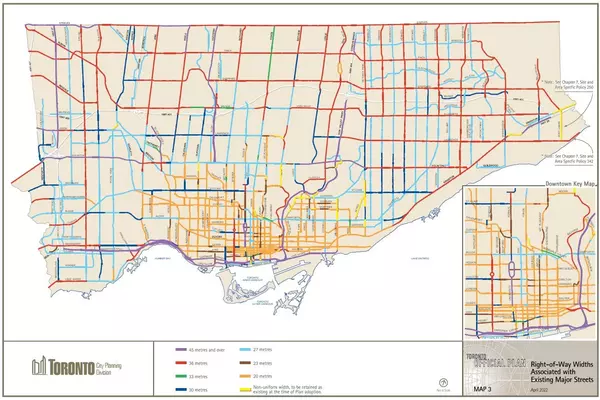

“As of Right” 4 Unit Zoning:

In April 2023 the city of Toronto approved “as of right” zoning for 4 plexes all across the city. This means that any property in the city can be turned into a 4 plex without any special permission. This new bylaw not only creates the possibility for more multiplex (low density) inventory in the city, but it also creates certainty for investors and significantly speeds up the approval and building process.

This provision benefits investors by allowing them to both maximize rental returns for their properties (small units rent for more on a per square foot basis) as well as allowing them to reduce their rental risk by diversifying their tenant pool (Not putting all their eggs in one basket).

Development Charge Exemption:

Prior to June 2022, anyone looking to legally add a unit to a property would have had to pay a development charge tax of $50,000 for each 1 bedroom and $80,000 for each 2 bedroom. This means for anyone trying to convert a single family home into a 6 bedroom triplex (3 x 2 bedrooms) would have had to pay $160,000 in development charges alone. In June 2022, the city of Toronto removed these development charges for up to 4 units in a property. This change directly aligns and compliments with the 4 unit “as of right” zoning mentioned above, and is further evidence of the government’s motivations and goals.

In addition to the above, development charges have also been removed for laneway houses and garden suites.

Combined together, this policy change has create hundreds of thousands of dollars in potential savings when compared to years past.

No HST on New Builds:

In 2023, both the Federal and Provincial governments announced that HST would not apply to the construction of new rental housing of at least 4 units. Typically, when building a rental property, an investor will have to pay HST on both their trades as well as on the building supplies. Since landlords do not collect HST on residential rents, there is no way for them to offset or recoup those costs.

This new program now solves that equation and results in tens, if not hundreds of thousands of dollars worth of savings for investors.

MLI Select Financing:

Simply put…this program is special. If you take one thing from this blog, it’s that you should take the time to fully understand what the MLI Program is and the benefits it can bring to you as an investor. It’s a very unique financial vehicle that has the ability to both reduce the risk and massively increase the value of any real investment.

The MLI program can be used to finance properties with a minimum of 5 units. In Toronto, this can be achieved by combining a 4 plex (which is now “as of right”) with a laneway house or garden suite. Below are the unique benefits of the MLI Select program:

- 90% Purchase and Construction Financing.

- Low Fixed Rate

- 50 Year Amortization

- Limited Recourse Loan

- No Ongoing Income Barriers

Conclusion:

Combined together, the government's recent policy changes have create a unique and lucrative opportunity for investors. Their actions have made clear that the "missing middle" is the exact type of real estate investments that want investors to focus on.

As with all government policies, these benefits should be looked at as temporary and the most proactive investors will be the ones that benefit the most from them.

When you combine the temporary pause in price increases with the potential to save hundreds of thousands of dollars in development charges and HST payments as well as to power of the MIL select program, 2024 has the ability to one of the best investment opportunieis in years.

Categories

Recent Posts