2024 Real Estate Trends: Canada, Mexico, and the Caribbean

Reuters recently conducted a poll of 130 international housing analysts, including representatives from property markets in the U.S., Britain, Germany, Australia, New Zealand, and India, which showed that the double-digit housing price declines they anticipated failed to occur, and that they’re upgrading their forecasts for 2024. While some areas did experience price declines in 2023, analysts expect prices to rise in 2024.

For the economies with the fastest house inflation, such as the U.S., Canada, New Zealand and Australia, analysts believe that most central banks are unlikely to cut overnight borrowing rates to retail lenders, and that demand from homebuyers in most Western markets will keep prices higher ensuring affordability remains an issue.

Beginning with the U.S., Realtor.com says housing prices soared with the onset of the pandemic, changing household priorities amid safety concerns. Then, in 2022, mortgage interest rates rose from just over 3% to 7%. Rates wobbled toward 8% in 2023, even while home prices continued to rise, but rates helped reduce sales volume by nearly 19% to 4 million units from the 5 million homes sold in 2022. Heading into 2024, Realtor.com forecasts that market conditions have little changed and that, while mortgage interest rates will ease to 6.5%, existing homeowners still don’t have much incentive to sell, so inventory will remain tight against demand. More than 90% of homeowners with loans have a rate of less than 6% and two-thirds have a rate under 4%. Corelogic.com forecasts that 2023 will end with a 4.7% rise in home prices, but that price growth will slow to 2.9% in 2024.

Canada

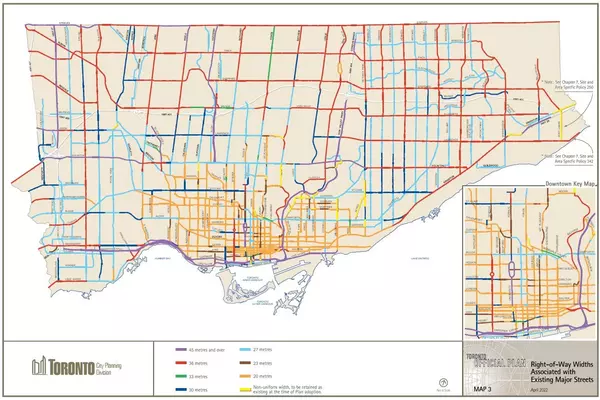

In Canada, the Canadian Real Estate Association reported that housing sales are still in a downward trend, falling by 5.6% in October 2023. Home sellers are waiting until spring 2024 to list their homes for sale as homebuyers “hibernate” for the winter, while new listings are at a 20-year low. The average Canadian home price was around $656,000 in October, according to CREA, an increase of 1.8% year-over-year.

From a low of 3.1 months of listing supply in May 2023, inventories have risen to 4.1 months’ supply, still below the long-term average for Canada of five months’ supply on hand. The sales to new listings ratio—a metric that compares the number of homes sold in a given time versus the number of new listings—slipped from 67.9% in April 2023 to 49.5% in October—a 10-year low. A ratio around 50% indicates a balanced market between homebuyers and sellers, a higher number suggests a seller’s market and a lower number means a buyer’s market. Canada’s long-term average is about 55%.

Like the United States, Canada is waiting for its central bank, the Bank of Canada, to either increase interest rates again or make its first cut to overnight borrowing rates, making it difficult to predict the spring market to the end of 2024. The Canada Mortgage and Housing Corporation (CMHC) predicts that after home prices hit bottom for this market cycle, that they’ll start rising again in 2024 to an average of $694,196 and $746,410 in 2025. With inflation and higher interest rates still an issue, the CMHC doesn’t expect prices to revisit where they were before the onset of the pandemic in 2020.

Mexico

In 2023, Mexico’s residential real estate market is estimated to reach $13.93 billion and rise to $17.07 billion by 2028, according to Mordor Intelligence. Mexico is a well-known tourist and vacation homebuyer destination, which is producing higher demand for resort and second home properties. Young people are also demanding a place to live, with those under 30 years of age (55% of Mexico’s total population) driving development. One titillating stat from Numbeo shows rental properties in Mexico offer gross rental yields ranging from 6.3% to 9.0%.

TheLatinInvestor.com recommends certain considerations for any foreign property investor. The first is the country’s stability. According to the Fragile States Index, Mexico’s stability score is 69.8, which places it in the “warning” or mid-range category, compared to Canada’s enviable score of 18.9 and the United States at 45.3, but stability is improving as the government implements economic reforms and continues to reduce crime and violence. Mexico has also worked to strengthen diplomatic ties with other countries.

The second consideration for investors should be a country’s economy. Mexico is expected to experience a 3.3% inflation rate for the next five years, which is a good hedge for property owners. Property values and rental rates will increase, which all but assures investors of making a profit. The International Monetary Fund predicts that Mexico’s gross domestic product will end 2023 with a gain of 1.8%, and in 2024 will go slightly lower to 1.6%. Over the next five years, GDP is expected to average 1.7%.

The Caribbean

Gorgeous white sand beaches, sparkling turquoise waters, lush tropical landscapes, year-round sunshine, and warm temperatures make the Caribbean one of the most attractive places on earth for luxury vacations, second homes and investment property.

Statistica research concludes that the value of the real estate in the Caribbean will reach $1.70 trillion in 2023, and values will rise 5.0% annually, resulting in a market volume of $2.17 trillion by 2028. Most of this will be investments in upscale residential real estate by international buyers, who feel confident because of the Caribbean’s “underlying macroeconomic factors,” including stable economic growth in recent years, favorable government policies, and a shift in preferences for more luxurious properties. Developers are focusing on high-end projects to cater to this wealthy sector.

Explains LatinCarib.com, there are numerous incentives for foreign investment. Foreign buyers can get free title to their real estate, and there are also tax incentives for investors and a streamlined property acquisition process has also made a difference.

The Bahamas, once a territory under Great Britain’s rule until 1973, is an independent self-ruled country. There is no income tax, capital gains tax or inheritance tax, but there are substantial transaction costs between 9.1% and 25.5%. There are limitations, however, for foreign investors if the property they want to buy exceeds two acres, is being purchased to rent out, or is for commercial development.

Incentives are similar in Aruba, with foreigners able to buy property easily with about 40% down. A territory of the Netherlands, the 69-square-mile island sits outside of the hurricane belt about 15 miles north of Venezuela in the southern Caribbean and boasts a somewhat arid climate.

The Cayman Islands is a self-governing British Territory composed of three islands totaling 102 square miles, and enjoys the highest standard of living in the Caribbean, as well as one of the highest in the world. Like other areas affected by high interest rates, rising prices, and reduced construction, homebuying demand from locals is hampered, but it remains robust for foreign investors. Projected GDP growth is 2.3% in 2023, but is expected to decelerate to 1.6% in 2024. Growth is forecasted at 2.0% in 2025 and 2.2% in 2026. Real estate growth is fractional at 0.2% in 2023, and is expected to contract by 1.2% in 2024, before rebounding by 2.0% in 2025 to 2026.

The Caribbean islands are the closest formation to Florida, which means that the island economies are closely linked to the U.S. economy. Most foreign investors are American, Canadian, and European.

These forecasts for Canada, Mexico, and the Caribbean are subject to change. According to the National Association of REALTORS®, the biggest factors to impact real estate sales and investment are global unrest, economic uncertainty, and eroding home affordability.

Categories

Recent Posts