New Capital Gains Rules in Canada: Impact on Real Estate

The 2024 Federal Budget has introduced significant changes to the capital gains inclusion rate in Canada, which will impact the real estate sector. The key changes are:

Increase in capital gains inclusion rate

The inclusion rate will increase from 50% to 66.67% for capital gains realized by corporations and trusts on or after June 25, 2024. For individuals, the inclusion rate will increase to 66.67% for capital gains above an annual threshold of $250,000. This means that individuals will pay more tax on their capital gains, making it more expensive to sell investment properties.

Impact on market segments

The changes will result in a higher tax rate on capital gains from the sale of real estate properties, including:

-

Investment properties (rental properties, condos, etc.)

-

Cottages and vacation homes

-

Flipped properties (properties bought and sold quickly for a profit)

-

Primary residences (in certain situations, such as if the property was previously rented out or used for business purposes)

Examples:

-

John purchased a rental property for $500,000 and sold it for $749,000. His capital gain is $249,000. Because the gain is less than $250,000 he will pay tax on 50% of the gain, which is the same as the previous tax.

-

Sarah purchased a cottage for $300,000 and sold it for $1,000,000. Her capital gain is $700,000. Under the old rules, she would have paid tax on 50% of the gain ($350,000). Under the new rules, she will pay tax on 66.67% of the gain ($462,000).

Planning opportunities

Taxpayers may consider:

-

Accelerating the realization of capital gains before June 25, 2024, to avoid the higher inclusion rate

-

Using the $250,000 annual threshold for individuals to minimize tax liability

-

Utilizing the lifetime capital gains exemption for qualified small business corporation shares and qualified farm or fishing property

-

Considering a tax-deferred rollover for qualified small business corporation shares and qualified farm or fishing property

-

Spreading out capital gains over multiple years to minimize tax liability

-

Transferring properties to a spouse or children to utilize their lower tax brackets

Impact on overall real estate market

The changes may lead to:

-

An increase in property sales before June 25, 2024, as taxpayers seek to avoid the higher inclusion rate

-

A potential slowdown in the market after June 25, 2024, as the higher inclusion rate takes effect

-

Increased demand for tax planning and advice from real estate professionals and tax experts

-

A shift towards more tax-efficient investment strategies, such as investing in registered accounts or using tax-deferred exchanges

Exemptions and reliefs

The new rules provide some exemptions and reliefs, including:

-

The annual $250,000 threshold for individuals

-

The lifetime capital gains exemption for qualified small business corporation shares and qualified farm or fishing property

-

Tax-deferred rollovers for qualified small business corporation shares and qualified farm or fishing property

-

The principal residence exemption (PRE) for primary residences

-

The ability to claim a capital loss to offset capital gains

Frequently Asked Questions

-

How do the new capital gains rules affect my primary residence?

-

The principal residence exemption (PRE) still applies, but the new rules may affect the tax implications if you previously rented out or used your primary residence for business purposes.

-

Can I still claim a capital loss to offset capital gains?

-

Yes, the ability to claim a capital loss to offset capital gains remains unchanged.

-

How do the new rules affect my business or investment strategy?

-

The new rules may affect the tax implications of your business or investment strategy, and you should consult with a tax professional or financial advisor to determine the best course of action.

-

What is the annual threshold for individuals, and how does it work?

-

The annual threshold is $250,000, and it means that individuals will not pay tax on the first $250,000 of capital gains. Any gains above this threshold will be subject to the higher inclusion rate.

-

Can I transfer my property to a family member to avoid the higher inclusion rate?

-

Yes, but this may trigger a deemed disposition, and you should consult with a tax professional or financial advisor to determine the best course of action.

-

How do the new rules affect my estate planning and will?

-

The new rules may affect the tax implications of your estate planning and will, and you should consult with a tax professional or financial advisor to determine the best course of action.

-

What is the deadline for realizing capital gains to avoid the higher inclusion rate?

-

June 25, 2024

Categories

Recent Posts

Prestige Magazine Fall 2024

3 Government Changes You Should Know About

Why now is the time to buy. (In 3 charts)

October 2024 Detailed Market & Mortgage Report

Critical Changes to Insured Mortgages & Their Benefits

2024/25 BHHS Global Luxury Landscape Report

20 Year Investment Story - Basement Apartment

2024 Fall Market Predictions

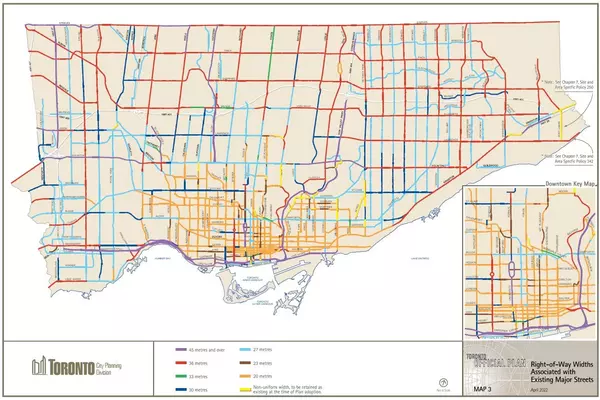

The opportunity in Toronto's new "major street" bylaw.

June 2024 Detailed Market & Mortgage Report