The missed opportunity in today’s market.

Toronto's real estate market is facing a unique challenge - a gap between older sellers and younger buyers. This gap is rooted in the differing priorities and circumstances of these two generations, leading to a mismatch in the housing market.

Older Homeowners: No Desire to Modernize

Many older homeowners in Toronto are reluctant to modernize their properties, and it's not just about the cost. They often lack the desire, connections, and will to renovate, preferring to maintain their homes as they are. Additionally, many older homeowners may not qualify for loans without a steady income, making renovations a financial burden.

Here are some potential reasons why older homeowners might be hesitant to modernize their properties:

-

Emotional attachment: Older homeowners may have an emotional attachment to their homes and the memories they've made there. They may feel that renovating would erase those memories or change the character of their home.

-

Lack of knowledge: Older homeowners may not be familiar with the latest design trends, technologies, or building materials, which can make the renovation process seem overwhelming.

-

Fear of disruption: Renovations can be disruptive and chaotic, especially for older adults who value their routine and quiet lifestyle.

-

Physical limitations: Older homeowners may have physical limitations that make it difficult for them to manage a renovation project, such as mobility issues or chronic health conditions.

-

Social isolation: Older adults may be socially isolated, which can make it harder for them to connect with contractors, designers, and other professionals who can help them with renovations.

-

Financial constraints: As you mentioned, many older homeowners may not qualify for loans without a steady income, making renovations a financial burden.

-

Prioritizing other expenses: Older adults may have other financial priorities, such as healthcare expenses, travel, or supporting family members, that take precedence over home renovations.

-

Lack of trust: Older homeowners may be hesitant to trust contractors, designers, or other professionals with their home and their money.

Younger Buyers: Stretching Themselves Thin

Younger buyers in Toronto are eager to find modern and renovated homes, but they're already stretching themselves financially with down payments and mortgages. They may not have the means to fund renovations through other loans, and their busy lives with long work schedules and family responsibilities make it difficult to take on the added stress of renovations.

Here are some potential reasons why younger buyers in Toronto may be hesitant to take on renovations:

-

Financial strain: Younger buyers may be already stretching themselves financially with high down payments and mortgages, leaving them with limited funds for renovations.

-

Lack of additional savings: They may not have enough savings to cover the costs of renovations, which can be a significant expense.

-

High debt-to-income ratio: Younger buyers may have high debt-to-income ratios, making it difficult for them to qualify for additional loans or credit to fund renovations.

-

Busy lives: They may have demanding work schedules and family responsibilities, leaving them with limited time and energy to manage a renovation project.

-

Lack of expertise: Younger buyers may not have the necessary expertise or experience to manage a renovation project, which can be overwhelming and stressful.

-

Fear of the unknown: They may be hesitant to take on renovations because they're unsure of the costs, timelines, and potential surprises that can arise during the process.

An Opportunity for the Willing and Able

This gap in the market creates an opportunity for those who are willing and able to renovate a home.

For sellers, making the effort to update at least part of the home, can generate a significant return on investment. Redoing a roof, replacing windows, updating electrical or improving a kitchen or bathrooms are all investments that a potential buyer will not have to make out of their own pocket (as opposed to included in a mortgage). This will make the property significantly more attractive to a larger pool of buyers.

For buyers, properties that need more work can be purchased at better prices with less competition. For those who can see beyond the cosmetic issues and envision a modern and renovated space, this gap presents a chance to own a dream home at a more affordable price.

Here are some potential benefits for those who are willing and able to purchase a home that needs to be renovated:

-

Affordable prices: Properties that need more work can be purchased at lower prices, making them more affordable for buyers.

-

Less competition: There may be less competition for properties that need more work, making it easier for buyers to purchase the home they want.

-

Customization: Buyers can customize the property to their liking, creating a modern and renovated space that suits their needs and tastes.

-

Potential for profit: Renovating a property can increase its value, providing a potential profit for buyers who decide to sell in the future.

-

Personal satisfaction: Renovating a property can be a fulfilling experience, allowing buyers to create a home that reflects their personality and style.

Overall, the gap in the market between older sellers and younger buyers presents an opportunity for those who are willing and able to renovate a home. By capitalizing on this gap, both buyers and sellers can benefit from being bold and proactive.

Categories

Recent Posts

Prestige Magazine Fall 2024

3 Government Changes You Should Know About

Why now is the time to buy. (In 3 charts)

October 2024 Detailed Market & Mortgage Report

Critical Changes to Insured Mortgages & Their Benefits

2024/25 BHHS Global Luxury Landscape Report

20 Year Investment Story - Basement Apartment

2024 Fall Market Predictions

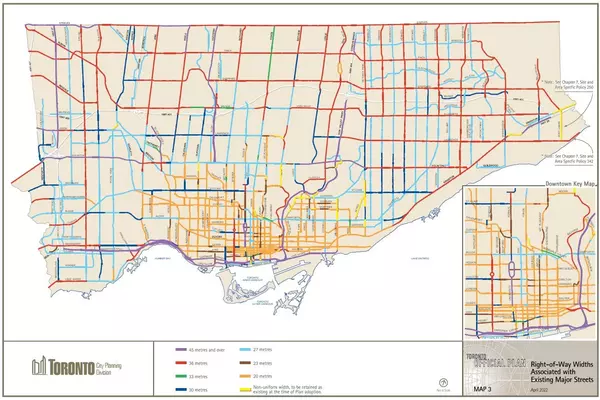

The opportunity in Toronto's new "major street" bylaw.

June 2024 Detailed Market & Mortgage Report