2024 Fall Market Predictions

To understand where the real estate market in the Greater Toronto Area (GTA) might be headed, it's crucial to first examine where it has been.

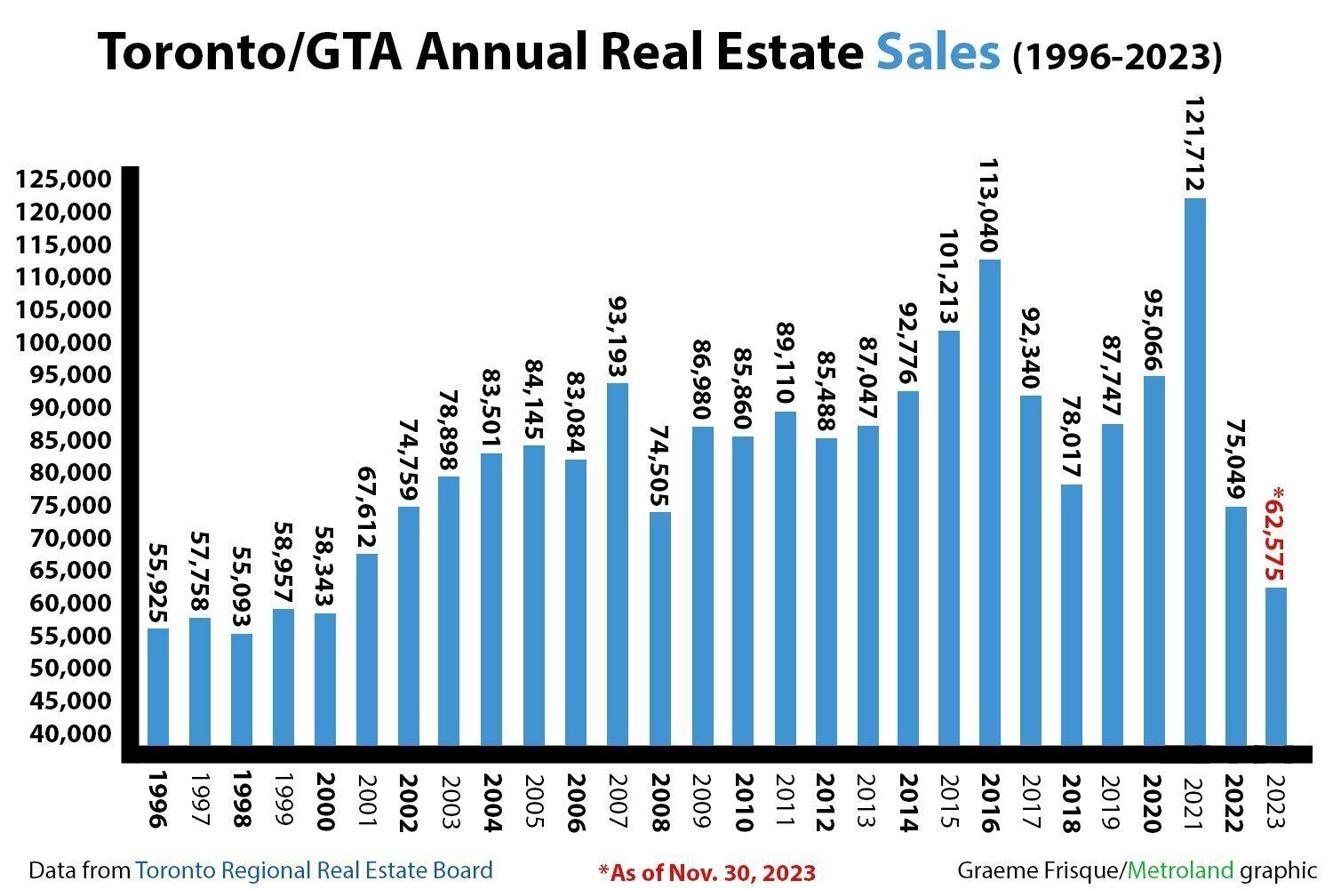

Prior to 2022, the Toronto Real Estate Board recorded only two years in the past two decades where sales volumes fell below 80,000: in 2008 and 2018. Over this period, annual transaction volumes averaged just under 90,000, with a low of 74,500 in 2008 and 78,000 in 2018. However, the last three years have seen an unprecedented drop in yearly transactions, with 75,000 in 2022, 66,000 in 2023, and a projected pace of 63,000 for 2024.

The decline in sales volume began concurrently with the Bank of Canada's initial rate hike in 2022, indicating a strong correlation between interest rate changes and market activity.

So, what lessons can we learn from past trends, and what do they suggest about the months and years ahead?

The 2008 market downturn was driven by the global financial crisis. The stock market crashed, unemployment surged, access to financing tightened, and consumer confidence plummeted. In January 2008, the Bank of Canada initiated a series of interest rate cuts, reducing the overnight rate from 4.5% to 4.25% (coincidentally the current rate is also 4.5%). Although these cuts took time to influence the market, by 2009, the overnight rate had dropped to 1%, and real estate transaction volumes and prices began to rise.

Similarly, 2018 was marked by shifting interest rates. After several years with a 0.5% overnight rate, the Bank of Canada began raising rates in July 2017, peaking at 1.75% by the end of 2018. Additionally, 2018 introduced the mortgage “stress test” for uninsured mortgages, significantly affecting buyers' purchasing power. This combination of the stress test and rising rates put short-term downward pressure on the market. Unlike in 2008, the rebound in sales in 2019 wasn't driven by a reduction in interest rates but rather by a pause in rate hikes and consumer adjustment to the stress test.

These examples highlight clear parallels to today’s market, where changes in mortgage and interest rates correlate with reduced sales volumes. However, unlike 2008 and 2018, today's market is experiencing higher inventory levels.

In 2008 and 2018, new listings actually decreased from the prior year and continued to decline the following year. This decrease in inventory put upward pressure on prices and tempered what could have been an even stronger rebound in sales transactions.

In contrast, new listings in 2024 have increased every month compared to 2023. This rise in inventory is exerting downward pressure on prices, particularly in the condo market. When you combine the current inventory levels, downward pressure on prices, and ongoing interest rate cuts, the evidence points to a strong rebound in sales volume in 2025.

“With another rate cut announced on July 24, we’ve now seen two rate cuts in a row, and the expected pace of future policy easing has steepened considerably, with markets now anticipating rate cuts at every remaining Bank of Canada decision this year,” said Shaun Cathcart, CREA’s Senior Economist. “Combine that with a record amount of demand waiting in the wings, and the forecast for a rekindling of Canadian housing activity going into 2025 has just gone from a layup to a slam dunk.”

In summary, given the historically low sales transactions over the past three years, pent-up buyer demand is at record levels. With interest rates almost certain to decrease significantly, combined with currently elevated inventory levels, transaction volumes are likely to increase substantially in the short to medium term. As for pricing, inventory levels for different property types will ultimately determine price trends. Condos may see prices remain flat or slightly decrease in the short term, while houses and townhouses are likely to see price increases driven by rate reductions and strong demand.

Categories

Recent Posts