Inheriting a Property in Canada

Inheriting a property in Canada can be a complex and emotional experience. Whether you're expecting to inherit a property or have already received one, understanding the process and its implications is crucial. In this blog, we'll explore the legal, financial, and tax aspects of inheriting a property in Canada.

Tax Implications

The moment someone passes away, the Canada Revenue Agency (CRA) considers all their assets as part of their estate and taxes this estate directly, before any money is released to beneficiaries. In other words, the reason you don’t pay taxes on an inheritance is because it has already been taxed.

An estate encompasses the total monetary value of a deceased person's investments, assets, and interests, including belongings, physical and intangible assets, real estate, investments, collectibles, and furnishings.

When someone passes away, three key steps occur:

- The legal representative files the final tax return.

- The Canada Revenue Agency (CRA) treats all property as sold the day before death, taxing accordingly (with exceptions for surviving spouses or common-law partners).

- The remaining estate is distributed to beneficiaries.

Secondary properties like cottages and rental properties are considered capital property. Upon death, the CRA treats these assets as sold at fair market value and a capital gain will apply to the profits made on the property.

Fifty percent of capital gains will be taxable and added to the deceased's income. The estate is then taxed based on the deceased's personal income tax rate when the final tax return is filed.

In short, the taxes will be paid from the estate prior to the transfer of the property, and not to the individual inherting it.

Principal Residences that are inherited are tax free at the time of transfer. However, if the property is held and sold at a future date, the person inheriting the house would be subject to capital gains on any increase in the value of the home. If the person inherting the house were to use the property as their own primary residence, then no capital gains would be owing at the time of sale.

For example, if parents purchased a home for $50,000 and the fair market value when inhertited is $800,000, there will be no tax at the time of inheritance. If the property is sold at a later date for $1,000,000, there will be a capital gain applied to the $200,000 increase in the value from when it was inherited.

Financial Considerations

Inheriting a property in Canada can also have financial implications:

-

Mortgage: If there's an outstanding mortgage on the property, the beneficiary may be responsible for paying it off.

-

Property Taxes: The beneficiary must pay property taxes on the inherited property.

-

Maintenance and Repairs: The beneficiary is responsible for maintaining and repairing the property.

Conclusion

Inheriting a property in Canada can be a complex and emotional experience. Understanding the legal, financial, and tax implications is crucial to navigating the process effectively. Seek professional advice from a lawyer, accountant, or financial advisor to ensure a smooth transition.

Categories

Recent Posts

Prestige Magazine Fall 2024

3 Government Changes You Should Know About

Why now is the time to buy. (In 3 charts)

October 2024 Detailed Market & Mortgage Report

Critical Changes to Insured Mortgages & Their Benefits

2024/25 BHHS Global Luxury Landscape Report

20 Year Investment Story - Basement Apartment

2024 Fall Market Predictions

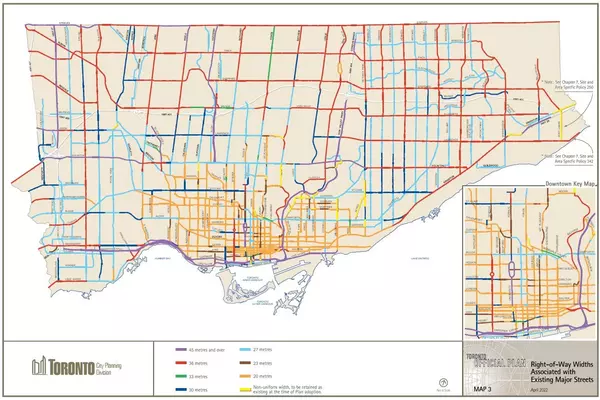

The opportunity in Toronto's new "major street" bylaw.

June 2024 Detailed Market & Mortgage Report