April 2024 Detailed Market & Mortgage Report

April 2024 home sales were down in comparison to April 2023, when there was a temporary resurgence in market activity. New listings were up strongly year-over-year, which meant there was increased choice for home buyers and little movement in the average selling price compared to last year.

Greater Toronto Area (GTA) REALTORS® reported 7,114 sales through the Toronto Regional Real Estate Board (TRREB) MLS® System in April 2024 – down by five per cent compared to April 2023. New listings were up by 47.2 per cent over the same period. On a seasonally adjusted monthly basis, sales edged lower while new listings were up compared

“Listings were up markedly in April in comparison to last year and last month. Many homeowners are anticipating an increase in demand for ownership housing as we move through the spring. While sales are expected to pick up, many would-be home buyers are likely waiting for the Bank of Canada to actually begin cutting its policy rate before purchasing a home,” said TRREB President Jennifer Pearce.

The MLS® Home Price Index (HPI) Composite benchmark was down by less than one per cent per cent year-over-year. The average selling price was up by 0.3 per cent to $1,156,167. On a seasonally adjusted month-over-month basis, the MLS® HPI Composite was up by 0.4 per cent and the average selling price was up by 1.5 per cent compared to March.

“Generally speaking, buyers are benefitting from ample choice in the GTA resale market in April. As a result, there was little movement in selling prices compared to last year. Looking forward, the expectation is that lower borrowing costs will prompt tighter market conditions in the months to come, which will result in renewed price growth, especially as we move into 2025,” said TRREB Chief Market Analyst Jason Mercer.

“All levels of government have announced plans and stated that they are committed to improving affordability and choice for residents. However, more work is needed on alignment to achieve these goals, whether we’re talking about bringing enough housing online to account for future population growth or finding the right balance between government spending and combatting inflation. We can’t have policies in opposition. Housing policy alignment is key to achieving sustained, tangible results,” said TRREB CEO John DiMichele.

Mortgage & Economic Outline Report

Report Contents:

- Major Banks’ Overnight Rate Forecast for 2024/25

- Bond yields and rate movement and drivers

- Key Upcoming Economic Announcement Dates

- US Fed vs. BofC - Can Canada Move First?

- Fixed vs. Variable - Comparison & Calculations

- GTA Housing Inventory is Rising - By How Much and Why?

---

Stats Outline Report & Database

|

In this month's Stats Outline Report and database, we analyze TRREB data for April 2024 (for the month, YTD, and rolling 12-months) relative to the past 10 years to try and uncover any new trends and insights. While the below report includes our macro level conclusions, details by region and zone can be found in the custom reports database link that follows. |

|

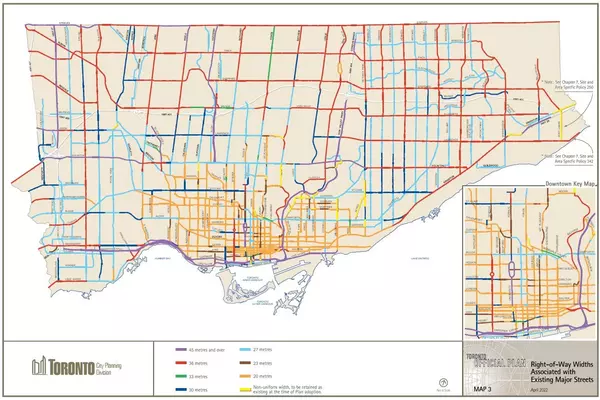

--- Location Specific Market Reports Below you will find detailed Executive Summary reports for each region in TRREB. Each Executive Summary Report includes a map of the included zones and a 17 page summary for each property type (detached, semi-detached, townhomes, condos)

|

All 416 Report | Core 416 Report | All 905 Report

Halton Report | Peel Report | Oakville Report | Burlington Report

Categories

Recent Posts