- Buy

- Sell

Current Listings

- 1/49 49

Free Account Required

Register or Sign In to View

Register For Price

*** Beds*** Baths*** SqFtAddress Not Disclosed

Townhouse

- 1/40 40

Free Account Required

Register or Sign In to View

Register For Price

*** Beds*** Baths*** SqFtAddress Not Disclosed

Condo

- 1/38 38

Free Account Required

Register or Sign In to View

Register For Price

*** Beds*** BathsAddress Not Disclosed

Condo

- 1/40 40

Free Account Required

Register or Sign In to View

Register For Price

*** Beds*** Baths*** SqFtAddress Not Disclosed

Condo

- 1/30 30

Free Account Required

Register or Sign In to View

Register For Price

*** Beds*** Baths*** SqFtAddress Not Disclosed

Condo

- 1/37 37

Free Account Required

Register or Sign In to View

Register For Price

*** Beds*** BathsAddress Not Disclosed

Condo

View all our listings.

How can we help?

Pre-Construction Projects

Get inside access to the top pre-construction projects in the GTA.

Upcoming Virtual Events

Making more informed and profitable real estate decisions.

Latest From The Blog

Prestige Magazine Fall 2024

We're thrilled to unveil the Fall 2024 issue of Berkshire Hathaway HomeServices Prestige magazine—your ultimate guide to today’s trending luxury lifestyle topics. In this edition, we dive into technological innovations in the hotel industry, the growing popularity of pickleball in upscale communities, and vibrant destinations like Park City, Key West, and Lake Maggiore, Italy. Read Latest Issue

Read More

3 Government Changes You Should Know About

The real estate landscape is constantly evolving, and recent government changes have introduced new opportunities and benefits for buyers, homeowners, and investors in Canada. If you're planning to buy, refinance, or expand your property portfolio, it’s essential to understand these updates. Here are three key changes that could impact your real estate decisions: 1. New CMHC Guidelines for Insured Mortgages As announced on September 16, 2024, the federal government is expanding eligibility for 30 year amortizations for insured mortgages to all first-time homebuyers and all purchasers of new builds, and increasing the $1 million price cap for insured mortgages to $1.5 million, effective December 15, 2024. Key Changes to CMHC Mortgage Rules: Increased Insured Mortgage Cap: The $1 million price cap for insured mortgages has been increased to $1.5 million, effective December 15, 2024, to reflect current housing market realities. Expanded Eligibility for 30-Year Amortizations: All first-time homebuyers and buyers of new builds will be eligible for 30-year mortgage amortizations, starting December 15, 2024. Impact: These new guidelines mean that more Canadians can access more of the housing market with lower down payments and manageable monthly payments. If you’re a first-time homebuyer or looking to enter the market, these updated guidelines could improve your chances of securing a mortgage and finding your dream home. 2. CMHC Secondary Suites Financing Program – Loans Up to $2 Million Many homeowners have extra space they may want to convert into rental suites, such as an unused basement, or a garage that could be converted into a laneway home. Historically, the cost of renovating, combined with municipal red tape, has made this both difficult and expensive. Key Updates to CMHC Loan Program: Maximum Property Value Limit: The “as improved” value of the eligible residential property against which the loan is secured must be less than $2 million. Maximum Loan-to-Value limit: Up to 90 per cent of the property value, including the value added by the secondary suite(s), in combination with any other outstanding loans secured by the property. Maximum amortization: 30 years. Additional Details: The project financing must not exceed the project costs. The cost of construction needs to be covered up from by the property owner and will be reimbursed on project completion. Impact: This program is a game-changer for homeowners looking to build wealth, offset cost of living and maximize the value of their property. Whether you’re an investor, current homeowner, or buyer looking for an income-generating property, this financing vehicle makes it easierier than ever to add rental spaces, build generational wealth, and make homeownership more financially feasible. 3. Mortgage Renewal Without Requalifying with a New Lender When a homeowners mortgage term is complete, they typically renew their mortgage for a new term at a new rate. Historically this process did not require the homeowner to requalify for the new loan, so long as they remained with the same lender. If they wished to "shop" for a better product, it required that they requalify should they move to a new lender - a process that could be daunting, and often times impossible. That has all changed under the new mortgage renewal guidelines eliminate the need for requalification when moving to a new lender, making it easier to shop for better rates and terms without the hassle of reassessment. Impact: “When consumers renew their mortgages, their ability to switch to a competitive mortgage offer is critical to ensure they obtain the best rate and terms to serve their needs,” the Competition Bureau said in a submission to the Department of Finance, noting that the share of uninsured mortgages has been growing, climbing to 73 per cent by mid-2023. These three government changes are designed to make homeownership, renewing financing, and investing in income producing properties easier and more accessible. Whether you’re a first-time buyer, homeowner, or property investor, staying informed about these updates can help you make more strategic real estate decisions in 2024 and beyond.

Read More

Why now is the time to buy. (In 3 charts)

With interest rates on the decline, it's not a matter of if, but when the real estate market in the Greater Toronto Area (GTA) starts to buzz again. If you’re on the fence about buying, there are three powerful reasons why now is the ideal time to make your move. Backed by data, we will walk you through the trends that reveal why waiting might mean missing out on substantial opportunities. Let’s dive into three key charts that highlight what’s currently unfolding in the GTA market: 1. Rate Drops = Price Growth Historically, every time interest rates have declined, the effect on GTA home prices has been unmistakable: sustained growth. This pattern isn’t unique to the GTA; it’s a basic market reaction. Lower rates mean mortgages become more affordable, which fuels demand and pushes prices up. In the past, rate reductions have consistently triggered price growth that continues long after the rates have dropped. This isn't just a short-term boost; it’s a sustained upward trend. A series of current and future rate cuts are all but a certainty —and with it, an opportunity for buyers to secure homes at prices that are likely to increase in the near future. 2. A Temporary Pause in Price Growth While prices in the GTA have shown resilience, they have temporarily paused in their upward climb over the past couple of years. Why? Simply put, high-interest rates have cooled down demand slightly. This pause has created a rare window for buyers to catch their breath and enter the market before prices pick up again. In other words, this momentary stabilization may be a short-lived opportunity. Many buyers have been sitting on the sidelines, but once rates drop, we could see a renewed rush into the market, driving prices back up. Taking advantage of this current pause allows buyers to get ahead of the curve and secure a property at a more manageable price point before the market heats up again. 3. High Inventory, High Choice For the first time in years, inventory levels are historically high in the GTA, particularly in townhouses and, even more so, condos. This increased supply gives buyers a tremendous advantage. When there are more options on the market, buyers have the power to negotiate. They can take their time, compare options, and even push for concessions that wouldn’t be possible in a tighter market. Condo and townhouse inventory in the GTA is at a level we haven’t seen in years, creating a unique buyer’s market in a traditionally seller-driven region. This high inventory means more selection, better deals, and the negotiating strength that is rarely seen in such a competitive market. In short, the combination ongoing rate drops, a temporary stabilization in prices, and an elevated inventory level offers a unique trifecta for buyers. If you've been thinking about entering the GTA market, now may be the best time to do so. You’ll have the opportunity to secure a property before prices pick up again, enjoy increased negotiating power, and choose from a diverse array of options.

Read More

October 2024 Detailed Market & Mortgage Report

Wow, what a few months! The Department of Finance has relaxed mortgage rules and the Bank of Canada has dropped their overnight rate by -0.50% (cumulative reduction of -1.25% since June 2024). In this month's Outline update, we include the following: Our most recent Economic/Mortgage Report Info guide on upcoming mortgage rule changes Bank of Canada's jumbo rate reduction Our most recent Stats Outline Report As always, should you have any questions or requests regarding this update, or any mortgage related inquiries at all, please reach out at any time. Mortgage & Economic Outline Report Please find below the links to this month's edition of the Mortgage & Economic Outline Report. Topics covered within this report include: Report Contents The Bank of Canada (BoC) Rate Announcement Major Banks’ Overnight Rate Forecast for 2024/25 Key Economic Reports and Dates to Watch Upcoming mortgage rule changes Mortgage Rules are Changing After almost two decades of policy tightening, the Federal government recently announced a number of changes to make mortgages more affordable and attainable. To help navigate the changes, and potential benefits, we have created the below info sheet which discusses the upcoming December 15th changes to insured mortgages. Please also refer to the mortgage outline report above for details on the upcoming changes to secondary suite financing effective January 15th, 2025. Click on the below image, to download the guide. A Jumbo Rate Cut Announcement Four in a row! On October 23rd, the Bank of Canada announced a jumbo rate drop of -0.50%. We've now had a combined reduction of -1.25% over the past 5 months, and we expect to see further rate cuts in the coming months. This brings the overnight rate down to 3.75% and the Prime rate is expected to follow by dropping to 5.95%. In the attached info guide we discuss what the recent rate drops could mean for you, why the Bank of Canada decided to lower rates, and what might be next. In the News (Mortgage & The Economy) The below list of articles and videos are curated from major news outlets across Canada and licensed and formatted for easy sharing across social media: Bank of Canada cuts its key interest rate by a half-point to 3.75% Inflation falls to 1.6%, making a case for larger Bank of Canada rate cut Canadian GDP beat estimates in July, but slowed in August, potentially bolstering case for larger rate cut Location Specific Market Reports Below you will find detailed Executive Summary reports for each region in TRREB. Each Executive Summary Report includes a map of the included zones and a 17 page summary for each property type (detached, semi-detached, townhomes, condos)The Information / statistics you can find in each Executive Summary Report include: Data comparing the – 1, 3, 5 and 10 year sales averages. Stats categories – Sales, New Listings, Active Listings, Average Price, Months of Inventory (MOI), Sales to New Listing Ratio (SNLR) All 416 Report | Core 416 Report | All 905 Report Halton Report | Peel Report | Oakville Report | Burlington Report York Report | Durham Report | Simcoe Report

Read More

Critical Changes to Insured Mortgages & Their Benefits

On September 16th 2024, the Canadian government made two massive updates to their insured mortgage guidelines. These changes will have a meaninful impact for first time and move up buyers. The newly announced rules now allow for any buyer to purchase a principal residence for up to $1.5 Million with a less than 20% down payment (previously $1 Million). In addition, first time homebuyers who purchase a property with less than 20% down will now be able to amortize their loans over 30 years (previously 25) which in turn will reduce their monthly mortgage paymens. These two changes will make purchasing a home significantly more achievable for many by requiring them to save less up front and by lowering their monthly mortgage payments. In this blog we will explain the insured mortgage process in detail including the qualification criteria, costs, benefits and financial examples. What Is an Insured Mortgage? When a buyer uses less than 20% for the downpayment of a property purchase, they must purchase "mortgage default insurance" for their mortgage loan. The cost of the insurance is based on the size of the loan and is added to the total mortgage amount and paid off through monthly mortgage payments. Insured mortgages were previously only available for properties that were purchased for under $1 Million but are now available for purchases up to $1.5 Million. The downpayment requirements depend on the purchase price of the home. The minimum down payment is 5% of the first $500,000 of the purchase price and 10% on the remainder. For example a property purchased for $1 Million would require a downpayment of $75,000. ($500k x 5% = $25k + $500K x 10% = $50k) Insured mortgages are available through all of the same lenders as a conventional mortgage and come with a number of advantages. Advantages of an Insured Mortgage Less Capital/Savings Required The number one barrier for buyers looking to enter or move up in the market is access to capital for a downpayment. Many buyers have the required income to obtain a mortgage, but lack the savings for the downpayment. The time required to save for a downpayment has become more and more challenging and has caused many people to give up on their home ownership goals. While insured mortgages have been available to buyers for years, the previous $1 Million purchase price limit was not aligned with current market pricing, and as a result was useless for most buyers. Under the new rules, a $1.5 Million property would require a $125,000 downpayment compared to $300,000 previously. Access to Lower Interest Rates Insured mortgages carry less risk for lenders since they are backed and guaranteed by default insurance. This lower risk allows the banks to provide lower mortgage rates to borrowers. Generally speaking, insured mortgages are .5% lower than the equivilant conventional loan. For example, if a 5-year fixed rate for a conventional mortgage is 4.79%, the 5-year fixed rate for an insured mortgage would be 4.29%. Easier Approval for First-Time Buyers First-time homebuyers, especially those with limited credit history or lower income, may find it easier to get approved for an insured mortgage. The insurance mitigates the lender's risk, which means you can qualify even with a smaller down payment. This opens the door to homeownership for those who might otherwise struggle to enter the market. Faster Market Entry Saving for a 20% down payment on a $1.5 Million property takes most people a number of years. For many, this creates a scenario where by the time they have the savings needed for a downpayment, property prices have grown beyond their reach. Entering the market as soon as possible is the only way to ensure that you aren't priced out of it. Entering the market also allows property owners to begin building equity through mortgage payments and increases in property values. Over the past 10 - 15 years, waiting to purchase a property in order to increase savings for a downpayment has been a costly strategy. Insured mortgages allow buyers to enter the market faster, and the updated guidelines now make them valuable and accessible for a huge segment of the buyer market. Purchase Example for $1.5 Million Property Under the previous rules, purchasing a $1,500,000 property would require a $300,000 (20%) down payment, and buyers would only have access to conventional mortgage rates. For context sake, as of the writing of this blog, that would equate to approximately 4.8% for a 5 year fixed mortgage. Under the new rules, the down payment required for the same purchase would be $125,000 and the mortgage rate would be 4.3% for a 5 year fixed mortgage. Insured Purchase - $170,000 Cash Needed Downpayment = $125,000 Land Transfer Tax = $45,000 Mortgage Insurace = $55,000 (Added to Mortgage) Monthly Payment = $6,897 Conventional Purchase - $345,000 Cash Needed Downpayment = $300,000 Land Transfer Tax = $45,000 Monthly Payment = $6,262

Read More

2024/25 BHHS Global Luxury Landscape Report

In the fast-paced world of luxury real estate, staying ahead of trends is essential. Our latest report offers an in-depth overview of global luxury markets, spotlighting critical trends such as wellness, design innovation, and the impact of AI. This comprehensive resource will help you understand and leverage the emerging trends that are shaping the future of luxury real estate. Read the report- 2024/25 Global Luxury Landscape Report

Read More

20 Year Investment Story - Basement Apartment

Renting out a basement apartment in Toronto can be a lucrative investment, especially if you’re prepared for the initial costs and committed to long-term growth. In this blog, we'll explore the potential earnings from renting a basement apartment over 20 years, factoring in a startup cost of $75,000, annual rent increases, and the impact of investing rental income in the stock market with an 8% average annual return. We’ll also calculate how long it would take to recover your initial investment and determine the overall Internal Rate of Return (IRR). Calculating 20 Year Increase in Wealth 1. Initial Setup Costs: $75,000 Before you start earning rental income, you’ll need to invest in setting up the basement apartment. These startup costs could include renovations, permits, and any necessary upgrades to make the space livable and legally compliant. For this analysis, we’ll assume a total startup cost of $75,000. 2. Starting Monthly Rent: $2,000 Let’s assume you start by renting the basement apartment at $2,000 per month. This translates to an annual income of $24,000. 3. Annual Rent Increase: 2% We’ll assume that rent increases annually by 2%, which is a typical rate aligned with inflation in Canada. Here’s how the rent and cumulative income would develop over 20 years: Year Monthly Rent Annual Rent Cumulative Rental Income 1 $2,000 $24,000 $24,000 2 $2,040 $24,480 $48,480 3 $2,081 $24,970 $73,450 4 $2,122 $25,469 $98,919 5 $2,165 $25,978 $124,897 10 $2,430 $29,158 $258,864 15 $2,740 $32,882 $432,314 20 $3,091 $37,092 $642,703 --- By the end of 20 years, the cumulative rental income would be $642,703. Recouping Your Initial Investment To determine how long it would take to recover the initial $75,000 investment, we’ll look at the cumulative rental income over the first few years: Year 1: $24,000 Year 2: $48,480 Year 3: $73,450 Year 4: $98,919 By the end of Year 3, your cumulative rental income would be $73,450, which is slightly below the initial investment. However, by the middle of Year 4, you would surpass the $75,000 mark, meaning it would take approximately 3.5 years to recoup your initial investment. Investing Rental Income in the Stock Market Now, let’s consider the potential earnings if you invest the rental income in the stock market, with an average annual return of 8%. We’ll assume that you reinvest the rental income monthly. 1. Monthly Investment We’ll start by investing the $2,000 monthly rent, and as the rent increases, the investment amount will also increase. 2. Compounding Growth Over 20 Years Given the monthly rental income and an 8% annual return, here’s how your investment portfolio might grow over 20 years: Year Monthly Rent Annual Investment Investment Growth (End of Year) 1 $2,000 $24,000 $24,962 2 $2,040 $24,480 $52,497 3 $2,081 $24,970 $83,731 4 $2,122 $25,469 $118,922 5 $2,165 $25,978 $158,354 10 $2,430 $29,158 $388,243 15 $2,740 $32,882 $718,817 20 $3,091 $37,092 $1,231,131 --- By investing your rental income monthly, your portfolio could grow to approximately $1,231,131 over 20 years. Calculating the Internal Rate of Return (IRR) The Internal Rate of Return (IRR) is a measure used to evaluate the profitability of an investment. It’s the discount rate that makes the net present value (NPV) of all cash flows (both inflows and outflows) equal to zero. 1. Cash Flows Initial Investment (Year 0): -$75,000 Annual Rental Income (Years 1–20): Starting at $24,000 and increasing annually by 2%. The IRR calculation considers the initial outflow of $75,000 and the annual inflows from rental income. Given the cumulative rental income and the compounding investment growth, the IRR for this investment would be approximately 14% over 20 years. This IRR reflects the combination of direct rental income and the compounded returns from investing that income in the stock market. Total Potential Earnings Over 20 Years Finally, let’s summarize your potential earnings: Total Rental Income: $642,703 + Investment Growth: $588,429 Total Potential Earnings: $1,231,131 After accounting for your initial $75,000 investment, the total net earnings would be $1,156,131 over 20 years. Additionally, the $75,000 investment will increase the value of the property at an exponential rate, ranging from $150,000 to $200,000. Conclusion Investing in a basement apartment in Toronto could yield nearly $1.3 million over 20 years when considering rental income, compounded investment growth as well as increased property value. With a startup cost of $75,000, you could recoup your initial investment in about 3.5 years, with an overall IRR of approximately 14%. This highlights the strong potential for real estate investments when combined with disciplined, long-term investing. If you’re considering renting out a basement apartment, understanding the long-term financial benefits and planning your investment strategy accordingly can help you maximize your returns and achieve substantial financial growth over time.

Read More

2024 Fall Market Predictions

To understand where the real estate market in the Greater Toronto Area (GTA) might be headed, it's crucial to first examine where it has been. Prior to 2022, the Toronto Real Estate Board recorded only two years in the past two decades where sales volumes fell below 80,000: in 2008 and 2018. Over this period, annual transaction volumes averaged just under 90,000, with a low of 74,500 in 2008 and 78,000 in 2018. However, the last three years have seen an unprecedented drop in yearly transactions, with 75,000 in 2022, 66,000 in 2023, and a projected pace of 63,000 for 2024. The decline in sales volume began concurrently with the Bank of Canada's initial rate hike in 2022, indicating a strong correlation between interest rate changes and market activity. So, what lessons can we learn from past trends, and what do they suggest about the months and years ahead? The 2008 market downturn was driven by the global financial crisis. The stock market crashed, unemployment surged, access to financing tightened, and consumer confidence plummeted. In January 2008, the Bank of Canada initiated a series of interest rate cuts, reducing the overnight rate from 4.5% to 4.25% (coincidentally the current rate is also 4.5%). Although these cuts took time to influence the market, by 2009, the overnight rate had dropped to 1%, and real estate transaction volumes and prices began to rise. Similarly, 2018 was marked by shifting interest rates. After several years with a 0.5% overnight rate, the Bank of Canada began raising rates in July 2017, peaking at 1.75% by the end of 2018. Additionally, 2018 introduced the mortgage “stress test” for uninsured mortgages, significantly affecting buyers' purchasing power. This combination of the stress test and rising rates put short-term downward pressure on the market. Unlike in 2008, the rebound in sales in 2019 wasn't driven by a reduction in interest rates but rather by a pause in rate hikes and consumer adjustment to the stress test. These examples highlight clear parallels to today’s market, where changes in mortgage and interest rates correlate with reduced sales volumes. However, unlike 2008 and 2018, today's market is experiencing higher inventory levels. In 2008 and 2018, new listings actually decreased from the prior year and continued to decline the following year. This decrease in inventory put upward pressure on prices and tempered what could have been an even stronger rebound in sales transactions. In contrast, new listings in 2024 have increased every month compared to 2023. This rise in inventory is exerting downward pressure on prices, particularly in the condo market. When you combine the current inventory levels, downward pressure on prices, and ongoing interest rate cuts, the evidence points to a strong rebound in sales volume in 2025. “With another rate cut announced on July 24, we’ve now seen two rate cuts in a row, and the expected pace of future policy easing has steepened considerably, with markets now anticipating rate cuts at every remaining Bank of Canada decision this year,” said Shaun Cathcart, CREA’s Senior Economist. “Combine that with a record amount of demand waiting in the wings, and the forecast for a rekindling of Canadian housing activity going into 2025 has just gone from a layup to a slam dunk.” In summary, given the historically low sales transactions over the past three years, pent-up buyer demand is at record levels. With interest rates almost certain to decrease significantly, combined with currently elevated inventory levels, transaction volumes are likely to increase substantially in the short to medium term. As for pricing, inventory levels for different property types will ultimately determine price trends. Condos may see prices remain flat or slightly decrease in the short term, while houses and townhouses are likely to see price increases driven by rate reductions and strong demand.

Read More

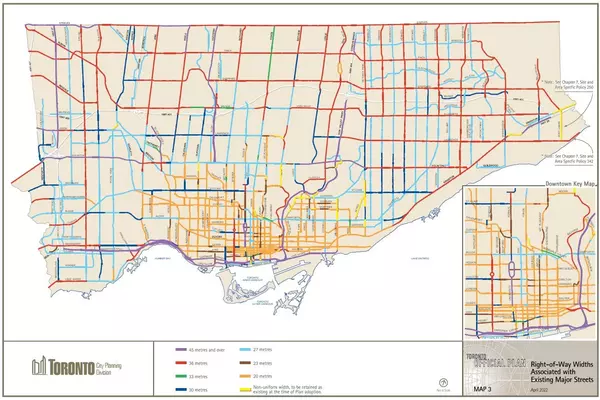

The opportunity in Toronto's new "major street" bylaw.

In a landmark decision, Toronto City Council voted 21-3 to approve the Major Streets plan, paving the way for more townhouses and six-storey residential buildings on major streets in residential areas. This move aims to create gentle density, increasing housing options and transforming the city's urban landscape. Under the new plan, properties located on designated "busy streets" (See map below) will be able to build up to 60 units and up to 6 storeys "as of right". This means that no special permission is required as long as a proposed development meets the City's zoning criteria. Key Highlights: Townhomes and small residential buildings can now be built on specific major streets without rezoning applications Apartment buildings can have up to 60 units and be up to 6 storeys 31,000 lots across the city will be opened up for development Properties that may have once been "less desireable" will see an increase in value Developers and investors have new lucrative opportunities "Major Streets" Map: Aiming for Housing Diversity: The goal is to provide a full range of housing options, making Toronto more affordable and livable. By expanding permissions for townhouses and low-rise housing, the city can: Support those who cannot afford detached or semi-detached homes Contribute to neighborhood stability Benefit families and young Torontonians looking to set down roots Improve/reduce development costs Addressing Housing Affordability: Toronto's housing market has long been characterized by high prices and limited options. The Major Streets plan aims to address this by increasing the supply of affordable housing, particularly in areas with good access to transit and amenities. Unique Investment Opportunity: There are a number of factors that make this a unique and lucrative investment opportunity for developers and investors. 1. Properties on "busy streets" are typically priced much lower than on more desirable streets. This is a short term opportunity that will most likely change moving forward. 2. The scale of the project provides more economies of scale when compared to a smaller tri-plex or four-plex investment. This provides investors with a higher and safer return on investment. 3. The projects allow for commercial financing options including the incredible CMHC MLI Select program. This program, outlined in a previous blog, allows for up to 95% purchase and construction financing, up to 50 year ammortizations as well as low fixed rates. Building on Previous Initiatives: This move follows recent gentle density initiatives, including: Legalization of multiplexes (up to four units) Legalization of garden suites and laneway suites These initiatives demonstrate the city's commitment to increasing housing options and promoting more efficient use of land. A New Era for Toronto's Housing Landscape: The Major Streets plan marks a significant shift towards creating more inclusive, diverse, and sustainable communities. By embracing gentle density, Toronto is taking a crucial step towards addressing housing affordability and providing more options for its residents. What's Next? As the city moves forward with implementing the Major Streets plan, residents can expect to see more townhouses and low-rise apartments popping up along major streets. Developers will have more flexibility to build innovative, family-friendly homes, and neighborhoods will become more vibrant and diverse. Conclusion: The approval of the Major Streets plan is a significant victory for Toronto's housing landscape. By embracing gentle density, the city is prioritizing affordability, sustainability, and community. As Toronto continues to grow and evolve, this move will play a crucial role in shaping its future as a livable, inclusive, and thriving city.

Read More